Iran To Set Next Year’s Minimum Monthly Wage At Around $200

Iran intends to set the minimum monthly salary for the next Iranian year (starting March 21) at 56 million rials, which is about $200 at today’s exchange rate.

Iran intends to set the minimum monthly salary for the next Iranian year (starting March 21) at 56 million rials, which is about $200 at today’s exchange rate.

Mohammad-Reza Mirtajodini, a member of the parliament’s budget committee announced the figure on Monday, noting that it is about 20 percent higher than what was proposed by the presidential administration.

According to Mirtajodini, 6 million rials will also be cut from payroll taxes. The government intends to raise asset taxes next year.

Iran has one of the lowest minimum wages in the world, but salaries were increasing from 20 years ago to about 10 years ago when the minimum wage hit a record high of about $275 in 2010. This coincides with the time when the United Nations Security Council began imposing sanctions to force Tehran to roll back its nuclear program.

Labor groups insist that the poverty line in Iran is now around $400 a month for a family of 3.3 people, so the proposed minimum wage is half of the needed money just to be able to survive.

Considering the roughly 60-percent rise in food prices this year and an over 40-percent inflation rate, most of the population is set to become dramatically poorer.

Earlier in the month, Iran’s parliament approved the broad outline of the budget with a significant number voting against the bill that would raise taxes and cut subsidies.

Small investors are exiting Tehran’s stock exchange after 18 months of losses, with the hope of making alternative investments and recoup some of their capital.

In the Iranian month of Day which ended on January 20, sixty trillion rials was taken out of the stock market, local media reported. Based on Tehran’s free market exchange rate on January 24, this equals $240 million, a small sum compared with the world’s large stock markets, but for Iran the amount in local currency and considering the size of the economy it is an alarming development.

The news comes as Iran’s high annual inflation rate hovering above 40 percent showed no sign of declining, and the value of the national currency remained near all-time lows against the US dollar, with 280,000 rials buying just one greenback.

In 1978, just before the overthrow of the pro-West monarchy, 70 rials bought one US dollar – a 4000-fold decline in 44 years.

The stock exchange index declined by a further five percent in the same 30-day period, prompting the exodus of capital from the market. Trading has been very low at the stock exchange with less than $100 million exchanging hands in one month. This is a sign of growing concern among small investors who have badly lost money in the market since mid-2020.

In early 2020 the stock index was less than 500,000 points until the government offered to sell its assets through the Tehran stock exchange which moved the index higher. Then the government began encouraging small investors to commit capital to the market. Top officials spoke through state-controlled media of the supposed benefits of buying stocks and securities. Amid the declining value of the rial and rising stock prices, many small investors concluded that investing in the stock market is a good way to protect their capital from devaluation.

The index rose to 2 million points by mid-2020 in an unbelievable bull market amid US sanctions and a deep economic crisis. Many people began investing when the market was already too high and then it crumbled to 1.2 million points, or a 40-percent decline, wiping out the savings of small investors.

With 18 months of declines or sideways movements, there is no hope for a quick recovery. The government keeps promising to fix the stock market value, as though it is a savings account that a bank must protect and is divorced from the real economy, which is in deep trouble.

There is little available private equity in the market as people have become distrustful of banks and the stock market, both of which the government can manipulate or mismanage. Reports in the past have said that Iranians hold more than $30 billion in cash at home, not trusting the rial, which has declined eightfold since late 2017.

With talks taking place with the United States over Iran’s nuclear program, there is hope that an agreement will end sanctions imposed by the former US administration in 2018. If that happens, it will help the rial to an extent, but the issue is that the government and its banks and companies are mired in debt and inflation. It would take years of high economic growth to save the economy, but in a centrally controlled system without foreign investments, and with cronyism and mismanagement that is a long shot.

Iran is installing sensors and cameras on roadside electrical equipment to help catch anyone stealing power cables and lamps.

An official from Iran’s Road Maintenance and Transportation Organization told ILNA Monday that theft of power cables and road equipment such as lamps and traffic signs had increased significantly.

Reza Akbari said that with most thieves on low incomes, heavy sentences were not possible, even though removing lights and signs threatened road safety. He added that thefts were happening both in provinces like Sistan-Baluchestan and Kerman with relatively light traffic and on roads just 50km from the capital Tehran.

The installation of GPS tracking devices on the most expensive equipment would enable the identification of major buyers of the stolen goods, Akbari said. Some had already been identified and referred to the judicial authorities, “unfortunately…[with] cases…in most of the provinces”.

With the purchasing power of Iranians in decline, shoplifting and burglaries have increased along with protests over working conditions and salaries. Food prices have jumped over 60 percent this year, following high inflation since the imposition of US ‘maximum pressure’ sanctions in 2018. Government figures show that prices for 83 percent of food staples have reached a level deemed ‘critical’ for those on broadly average wages.

The United Arab Emirates intercepted two Houthi ballistic missiles on Monday with no casualties, its defense ministry said, following a deadly attack a week earlier.

"The remnants of the intercepted ballistic missiles fell in separate areas around Abu Dhabi," the ministry said, adding it was taking necessary protective measures against all attacks.

Iran-backed Houthis who have been battling a Saudi-led coalition that includes the UAE, have repeatedly carried out cross-border missile and drone attacks on Saudi Arabia and launched an unprecedented assault on the UAE on January 17.

UAE newspaper The National cited residents reporting flashes in the sky over the capital around 4:30 a.m.

Saudi state media early on Monday said the coalition intercepted a ballistic missile, with remnants damaging workshops and vehicles in the south of the kingdom. It said late on Sunday that a ballistic missile fell in the south, injuring two foreigners and causing damage in an industrial area.

The Yemen conflict is largely seen as a proxy war between Saudi Arabia and Iran. UAE has reduced its direct military role in the past two years.

The Saudi-led coalition has ramped up air strikes on what it describes as Houthi targets in Yemen.

At least 60 people were killed in a strike on a temporary detention center in northern Saada province on Friday.

The coalition intervened in Yemen in March 2015 months after the Houthis ousted the internationally recognized government from Sanaa.

Reporting by Reuters

Gas consumption in Iran has hit a new record, prompting the oil minister to urge people to wear warm clothes and turn off heating when leaving home and work.

Iran's oil minister Javad Owji said on Sunday that with people’s cooperation gas consumption can be managed, urging people to reduce usage so that “we can pass the next 10 days without any problem."

Owji said that the gas consumption at homes, commercial and small industries was at 692 million cubic meters in the past 24 hours.

Moreover, the head of distribution at Iran’s National Gas Company, Mohammadreza Joulaei, said that cold weather in the coming days will increase consumption by a few million cubic meters per day as people turn up their heaters.

Joulaei said, “There are 28 million gas subscribers in the country,” warning that power plants and industries such as petrochemicals and steel would face supply cuts to provide gas to households.

With a cold spell gripping Iran in recent days and a surge in demand, shortages of natural gas have become acute and power stations are burning more dirty fuels, feeding air pollution.

Iran has the second largest reserves of natural gas in the world but is barely able to satisfy domestic demand as production steadily declines because of lack of investments in the oil and gas sector.

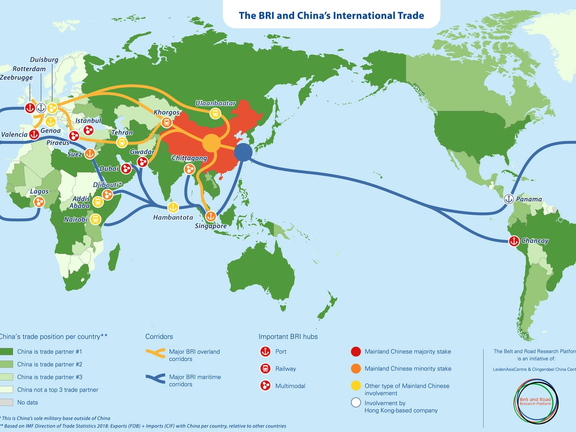

China is now the single largest investor and trading partner to 11 Middle Eastern countries, thanks primarily to its Belt and Road Initiative (BRI), a global, multi-trillion-dollar project.

China has significantly increased its economic, political, and security footprint in the Middle East through the BRI during the past decade. The ‘Belt’ runs from China, through South and Central Asia, and into Europe. The Maritime “road” connects coastal Chinese cities with Africa and the Mediterranean.

The Center for Economics and Business Research (CEBR) reported that China’s Belt and Road Initiative is likely to boost world GDP by $7.1 trillion annually within the next two decades. As attractive as that might sound, in addition to economic activity, China has geopolitical motivations behind its Belt and Road Initiative.

According to The Guardian, BRI projects have left 165 countries collectively owing a massive $385 billion to China. China systematically underreports stats like this to international bodies, such as the World Bank.

The Information office of the Chinese government reports the BRI has created more than 244,000 jobs for locals overseas. However, a vast majority of BRI projects require the use of Chinese companies, labor, and raw materials, meaning the GDP gains from BRI will go to the Chinese ‘locals,’ not to the locals of the countries in which China has invested.

Energy Security of People’s Republic of China

China’s top economic agencies have singled out “security” as a priority for 2022. In other words, securing the supplies of everything from grains to energy and raw materials. According to The Brookings Institution, “China’s growing role in the Middle East is positioning the rising superpower in direct confrontation with shifting U.S. interests in the domains of energy security, Israel, and Iran.”. The US finds itself reducing its footprint in the Middle East and shifting its focus towards the Asia-Pacific, giving China the opportunity to expand its influence in the region. Chinese economic dominance may invite similar regional skirmishes as the country seems happy to leverage risky debt against the countries it invests in to get what it wants diplomatically.

China’s relationship with the Middle East revolves primarily around Energy and the BRI. The Middle East and North Africa (MENA), a collective of 19 counties, has vast oil, petroleum, and natural gas reserves, making it attractive to China.

According to China Global Investment Tracker, Beijing heavily depends on Middle Eastern oil and gas. In addition to energy security, China’s strong diplomatic ties with MENA countries are vital to implementing BRI across several continents. Chinese State-owned lenders have been financing projects in Egypt, Iran, Saudi Arabia, Oman, the United Arab Emirates, and Djibouti, where Beijing has established its only overseas military base.

Djibouti, located in ‘The Horn of Africa’, also hosts U.S., French, and Japanese military bases. The international interest in Djibouti lies in the Bab El-Mandeb Strait, a strategic route for oil and natural gas shipments, connecting the Red Sea and the Indian Ocean. Its location makes the choke point geopolitically and economically significant.

The Energy Information Administration (EIA) reports, approximately “6.2 million barrels per day of crude oil, condensate, and refined petroleum products flowed through the Bab El-Mandeb Strait towards Europe, the United States, and Asia.” One-third of the world’s ships transporting energy and cargo must pass through the strait. Bab El-Mandeb is one among a series of trade and energy corridors in which China has invested stretching from the South China Sea to the Arabian Sea, referred to by India as a “String of Pearls.” India sees this investment as a sign of China’s growing military and trade prowess in the region. Indian critics are worried the BRI is a military initiative, aiming to give the Chinese Navy better access to the Indian Ocean.

China’s maritime “road” now stretches from western Xinjiang, through India, into the Persian Gulf. To implement BRI, China will need to achieve energy security within the Middle East, to keep its pace of development. To achieve energy security, China needs bases at every strategic port and chokepoint. As for the Gulf states’ approval of China, Iran announced the opening of a Chinese consulate in Bandar-Abbas, Iran’s most significant trading and military port on December 29th, 2021. Beijing has maintained close ties with Iran amid nuclear negotiations with the U.S. Iran recently signed a 25-year cooperation agreement with China, allowing China to invest $400 billion over 25 years in Iran. The Supreme Leader of Iran, Ayatollah Ali Khamenei, said, “The Islamic Republic will never forget China’s cooperation during the sanctions era.” It is essential to keep in mind, Iran’s cooperation with China may be a non-calculated reaction to its bad relations with the United States, and not a calculated strategic move on Teheran’s part, for its long-term development and international trade.Sorely needed economic injection investee countries like Iran, will receive from China, position China to earn favorable diplomatic preference throughout the developing regions through which BRI is implemented.

Debt-Trap-Diplomacy or Investee’s Incompetence?

China has been accused of strategically ensnaring investees with “debt-trap- diplomacy.” Unsustainable debt and the constrictive terms of Chinese loans have come under increased scrutiny in recent years, as more countries sign deals with China’s state-owned lenders. Concerns have centered particularly around some clauses that allow Chinese entities to seize property or assets when payments can’t be met. This has prompted worries of seizures of land or other assets, or debts that leave governments beholden to Beijing.

MI6 chief Richard Moore warned the BBC that China’s approach to loans often incorporates debt and data traps, which threaten to “erode sovereignty and have prompted defensive measures.”To vividly illustrate what Chinese debt traps look like in practice, observe the cases of Sri Lanka, Kyrgyzstan, and Montenegro, which are all falling short on their loan obligations to China, which refuses them self-sustainable growth.

Sri Lanka is currently experiencing a financial crisis from debts owed to China for highways, ports, airports, and a coal power plant. Sri Lanka’s President, Gotabaya Rajapaksa, has requested that China consider restructuring Sri Lanka’s debt repayments. According to Reuters, over the last decade, China has lent Sri Lanka over $5 billion.” Critics say China uses white elephant projects with low returns, which China has denied.

Similarly, Kyrgyzstan owes 40% of its foreign debt, $1.8 billion, to Chinese lenders. They grapple with repayments and meeting deadlines as the country faces financial troubles brought on by the COVID-19 pandemic.

In Montenegro, worries flared up after the government requested help from the European Union (EU) to pay off a $1 billion Chinese loan for a controversial, ongoing highway project. Montenegro’s economy is on the verge of derailment as a result: Montenegro’s debt has climbed to 100% of its GDP due to this project.What’s worse, “once completed, the road won't lead anywhere anyway. We make a joke: It is ahighway from nothing to nothing," says the country's former Justice Minister, Dragan Soc. The EU’s refusal to help Montenegro to pay its debt is an opportunity for China to grow its influence and foothold in Europe. Scott Morris, a senior fellow at the Center for Global Development says, “China is the top lender in the world, so it matters how it approaches these contracts.” Morris continues, “the general conclusion after looking at the contracts is that Chinese entities are issuing loans with the full intention of getting their money back.” China seems equally happy to swap debt for rights, ownership, and influence when the prospect of financial repayment becomes bleak for investees.

The ‘Non-Interference’ Policy, a False Sense of Security

China is using a ‘Non-interference’foreign policy, to differentiate its approach from the US, creating a false sense of security, as the very nature of BRI is invasive. China’s ’Non-interference’ policy, combined with the implementation of the BRI’s opaque contracts, creates opportunities for China to prevent having to take accountability for its actions abroad, similarly to how it’s already doing so domestically.

China needs the GCC’s approval to gain energy security in the region. Chinese Foreign Ministry spokesperson, Wang Wenbin said the Gulf Cooperation Council (GCC) Secretary-General, Nayef Falah Al-Hajraf, expressed firm support for China’s “legitimate positions on issues related to Taiwan, Xinjiang and human rights,” when the GCC members met with Chinese officials in Beijing early January of 2022. Wang continued to say they have expressed opposition to “politicization of human rights issues.”

United Nations revealed in 2018, that China has detained more than a million Muslim Uyghurs in the Xinjiang region as part of a campaign to wipe out their traditional culture, language, and beliefs. Al-Hajraf’s support of China’s detainment of Uyghurs, on behalf of the GCC—a body representing more than 54 million Muslims—sets an unsettling precedent for the way those populations may get treated in MENA countries through which the BRI extends.

China’s ‘Non-Interference’ foreign policy seems to be gaining attraction among authoritarian countries with stagnant economies; one being Iran. The Iran-China 25-year Cooperation Agreement is signed at a time when Iran is politically and economically isolated, which could have affected the terms of the agreement. The BRI’s record of economy-crippling projects in countries with economies stronger than Iran’s means that Iran may have a difficult 25 years ahead.