Qatar Signs Deal With Total For Expansion Of Gas Field In Persian Gulf

Qatar’s state-owned petroleum company has signed a deal with France’s TotalEnergies for developing its South Pars/North Dome Gas-Condensate field shared with Iran.

Qatar’s state-owned petroleum company has signed a deal with France’s TotalEnergies for developing its South Pars/North Dome Gas-Condensate field shared with Iran.

QatarEnergy, which announced Total as its first partner at the nearly $30 billion expansion project in the Persian Gulf on Sunday, added that more partners would be announced in the coming days. The expansion plan includes six LNG trains that will ramp up Qatar’s liquefaction capacity from 77 million tons per annum (mtpa) to 126 mtpa by 2027.

The news comes as Europe tries to replace Russian gas with supplies from other sources, and has directly courted Qatar as a major producer.

The French oil giant officially left Iran – along with Royal Dutch Shell, Russia’s Lukoil and Zarubezhneft, Italy’s Eni, Austrian group OMV and others – and abandoned a similar deal to develop the world's largest liquefied natural gas (LNG) project in August 2018, after former US president Donald Trump withdrew from the 2015 nuclear deal with Iran.

China National Petroleum Corp (CNPC) replaced Total taking over Total’s 50.1 percent stake, but it also suspended its investment in South Pars in 2018 in response to US pressure.

With lack of investment and technology, Iran’s gas production in the Persian Gulf is falling and currently inadequate even to cover rising domestic demand.

In February, the current oil minister Javad Owji said that “many major companies” have sent emails to the ministry and initiated discussions to participate in expanding Iran’s part of the gas field.

While Iran’s currency is losing value every day, Iran’s Economic Security Police has arrested more than 30 people over allegations of market manipulation.

Deputy Chief of the Economic Security Police, Brigadier General Sohrab Bahrami, announced Sunday that several “other such criminals” have been identified and will be dealt with soon.

Police will deal with these people for "disrupting the economic system," he said, and claimed that these people create false demand for the US dollar in the Iranian market, hence disrupting the market stability.

The Islamic Republic facing continuing economic crisis in the past 4 years often arrests dealers and businessman accusing them of rigging demand or supply, in an effort to show the public that it is proactive.

Last week, the police announced the detention of 16 so-called criminals in coordination with the judiciary and the Central Bank.

Iran’s rial is hitting new lows against the US dollar daily amid runaway inflation and economic chaos, with one US dollar surpassing 333,000 rials on Sunday.

The drop comes as the last rays of hope for reviving the 2015 nuclear deal between Tehran and world powers are fading away, with multilateral talks in Vienna paused since March.

Food prices have soared since early May when the government lifted import subsidies for essential goods to save foreign currency, and anti-government protests have become a regular scene in several cities.

More than 60 Iranian economists have issued a statement addressing the government saying that the main cause of Iran’s economic crisis is bad governance.

The signatories, mostly professors of economics in Iranian universities and many who have held government posts, suggest the government’s “economic surgery” since March has led to “social chaos and worsening economic instability.”

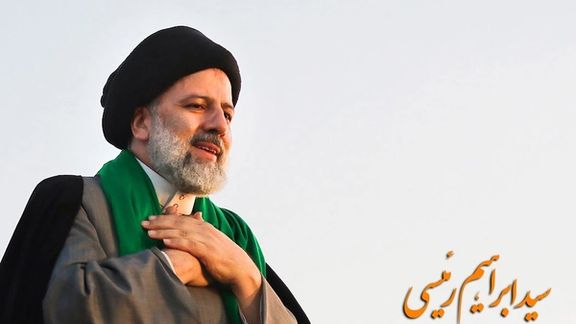

With the new Iran year beginning March 22, President Ebrahim Raisi with the backing of parliament began a plan to phase out state subsidies on food imports that had been costing $9-15 billion a year.

While in part a response to global food inflation sparked partly by the invasion of Ukraine, the move, quickly dubbed “economic surgery,” was officially portrayed as a serious reform of Iran’s state-dominated economy.

‘Quick measure in face of global price crisis’

The economists charged in their statement that the motivation was purely fiscal, easing a shortfall in the government budget, and that real reform required more serious change: “[The move was] a temporary and quick measure for addressing the budget deficit amid sanctions and a global food price crisis. We cannot consider this an economic reform.”

The economists argued that this “economic surgery” would lead to a further fall in the value of the Iranian rial and lead to “repeated economic shocks,” and said the government had not engaged with the public about where the policy would lead.

The economists noted Raisi’s election campaign promises to form an inclusive government, utilize experts to draft economic plans, slash “the 50-percent inflation rate,” and build one million housing units each year.

But the economists argued it would not be possible to fulfil such promises without an early agreement in talks with world powers to revive the 2015 nuclear deal and accession to international transparency and related regulations demanded by the Paris-based inter-state Financial Action Task Force (FATF), which blacklisted Iran in 2020.

Despite various restrictions on non-governmental media, many experts and business figures had warned over “the horrible” results of “inaction” in foreign policy and ill-designed policies, the economists said. Economic shocks and the pausing of nuclear talks in March had fed instability, social chaos, and widespread concern among the people over their livelihoods, creating an “explosive” situation.

They went on to warn that “the country’s situation is extremely fragile,” given the elimination of food subsidies. “People’s patience will run out and will place the government and the regime face-to-face with the people.”

Three recommendations

The signatories made three recommendations.

First, the state should have sufficient oil and non-oil export revenues and foreign currency reserves to ensure secure handling of economic fluctuations.

Second, the government should have clear and effective policies to foster macro-economic stability, with control over inflationary budgets.

Third, the government should ensure low-cost access to global markets for goods and services.

The last recommendation is related to extra costs Iranian government and businesses have to bear to do international transaction, given US sanctions and FATF’s blacklisting.

Low growth

The economists warned that Iran had lost ground economically compared with most other countries since 1980, with average growth of 1.6 precent, whereas growth in China, India, Turkey, Malaysia, the United Arab Emirates, and Pakistan had ranged from 4 to 10 percent.

The economists spoke of vanishing hopes, growing poverty and a widening income gap that have led to vengefulness in society. The resulting disorder exhibited itself in destruction of the environment, systematic corruption, widespread emigration, capital flight and brain drain.

The 61 signatories called for “fundamental change in foreign policy” aimed at peaceful coexistence, cooperation with neighbors, and interaction with the world’s economic powers. They also urged improvement in governance, with respect for law, minimizing corruption, establishing an independent judiciary, dialogue and transparency, and allowing “true economic competition” in society.

Iranian President Ebrahim Raisi and his visiting Venezuelan counterpart Nicolas Maduro have signed a 20-year cooperation pact to bolster ties in various fields.

The signing ceremony between the two allies, both subject to United States sanctions, was officially held in the presence of their high-ranking officials in the Iranian capital Tehran on Saturday, when most of the speeches focused on resisting US pressures.

The inking of the agreement "shows the determination of top officials from both sides to develop relations despite US and Western pressure," Raisi said during a joint news conference.” He added that "Venezuela has passed hard years but the people, officials and the president were determined to resist the sanctions. This is a good sign that proves to everyone that resistance will work and will force the enemy to retreat."

According to state media, the partnership agreement includes cooperation in science, technology, agriculture, oil and gas, petrochemicals, tourism as well as culture, but no tangible details were released about the accord.

Iran has also signed a 25-year cooperation agreement with China and a proposed 20-year deal with Russia exists, both lacking details and concrete plans. Partly because of this, some Iranian social media users go as far as claiming that the Islamic Republic is "selling out the country and its people" to China and Russia.

Despite Iran’s currency dropping to an all-time low against the US dollar on Saturday, as well as regular protests over rising prices, mismanagement and systematic corruption, the Iranian president said Washington's ‘maximum pressure’ on Iran has miserably failed, calling it a victory for Iran.

Maduro, in turn, said the pact covers different areas of cooperation including energy, oil, gas, refineries and petrochemicals as well as "working together on defense projects", adding that “We will use the historical experiences of Iran and put technology at the focal point of this cooperation agreement.” Maduro also talked about financing shared projects through the Iran-Venezuela Relations Development Bank.

“The youths of Iran and Venezuela must know that the world of the future is a world of equality and justice. We stand against imperialism, and together we must build the future. I tell the Iranian people to count on all our support and cooperation,” Maduro said.

In addition to the significant role of Iran’s Oil Minister Javad Owji in relations between Tehran and Caracas, Iran's Defense Minister Mohammad-Reza Gharaei Ashtiani is also said to have played an outsized role as he greeted Maduro at the airport and has been a constant presence in the engagements to date.

Iran and Venezuela have been slapped with sanctions by the US, which does not currently import oil from either nation, and has in recent years reimposed sanctions on Iranian state entities, including the national oil company NIOC, and in 2019 blacklisted Venezuela’s energy firm PDVSA.

The two countries strengthened their cooperation in 2020, with Venezuela importing condensate from Iran, key to thinning its extra-thick crude oil. Iran has also stepped in to help its South American ally with engineers, refined products and spare parts for its oil industry.

They also recently expanded a swap agreement signed last year to increase the supply of Iranian heavy crude to Venezuela's El Palito refinery and Paraguana Refining Center (CRP).

In early May, Owji traveled to Venezuela to visit oil facilities and sign contracts in the energy sector. Later in May, an oil tanker carrying about one million barrels of Iranian crude arrived in Venezuelan waters for delivery to the country's largest refinery.

The United States Special Representative for Iran Robert Malley held an “excellent” phone conversation with South Korean First Vice Foreign Minister Choi Jong-kun about Iran.

Malley said in a tweet on Friday that Washington and Seoul “are committed to coordinating our efforts across a wide range of shared interests on Iran.”

He did not elaborate on what exactly was discussed but the two diplomats probably talked about the Islamic Republic’s frozen assets in Korean banks due to US sanctions.

Since the beginning of the year, Iran and South Korea announced on several occasions that they would start negotiations to devise a mechanism to release the funds frozen, but nothing materialized.

Two South Korea banks hold $7-9 billion of Iranian money, owed for oil imports, but the funds are locked under US sanctions, which were reimposed after former President Donald Trump in 2018 withdrew from the Iran nuclear deal, Joint Comprehensive Plan of Action (JCPOA).

In April, Iranian media said $7 billion of Iran's frozen funds in South Korea will be freed in exchange for the release of three American dual citizens held as hostages in Tehran.

Iranian hardliner newspaper funded by Iran’s Supreme Leader suggested later in April that Iran must close the Strait of Hormuz to South Korean vessels until Seoul releases $7 billion frozen funds.

US National Security advisor Jake Sullivan said in May that Iran’s money in South Korea and elsewhere will remain frozen as long as a nuclear deal has not been reached.

Iran’s hard-hit currency dropped to an all-time low against the US dollar on Saturday as markets opened for business amid runaway inflation and economic chaos.

The rial approached 330,000 to one US dollar, falling by more than 25 percent since the end of March and tenfold since 2017, when it traded at around 33,000.

The drop came as Iran was censured by a resolution passed in an overwhelming vote at the International Atomic Energy Agency board meeting on Wednesday. The 35-nation board of governors criticized Tehran for not cooperating with the UN nuclear watchdog.

Iran’s nuclear talks with the United States and its European allies to restore the 2015 agreement known as JCPOA came to a halt in early March, prompting pessimism over the prospects of lifting US sanctions and providing a lifeline to Iran’s economy.

Food prices have soared since early May when the government lifted import subsidies for essential goods to save foreign currency. Economists in Tehran have warned of triple-digit inflation in the coming months.

Anti-government Protests took place in May as prices soared and the political environment remains highly volatile.

US oil export and banking sanctions imposed against Iran in 2018 by the former US administration triggered a serious economic crisis that has gotten worse amid government inefficiency.

The rial was trading at 70 against the US dollar in 1978, before the Islamic revolution. The currency has fallen close to 5,000-fold in 44 years.