Iran Lost 15% Of Funds Released By South Korea

Iran's ambassador in Seoul revealed on Monday that the conversion of its funds, released by South Korea earlier this year, resulted in a 15% loss.

Iran's ambassador in Seoul revealed on Monday that the conversion of its funds, released by South Korea earlier this year, resulted in a 15% loss.

Ambassador Saeed Koozechi told local media that Iran’s financial loss “should be somehow compensated for.” He clarified his remark by adding, "We can compensate for these damages by strengthening and expanding the existing cooperation and capacities between Iran and South Korea."

South Korea had frozen between $6-7 billion of Iran’s revenues from oil sales that occurred before the United States imposed full sanctions on Tehran in May 2019. After four years of Iranian demands to free the funds, the United States agreed in August to allow South Korea to unblock the funds in exchange for the release of five US citizens held hostage by Tehran.

However, the money had already been converted into Korean currency, won, and when it was converted back to euros, Iran sustained losses. In the four years since the money had been frozen, won lost more than 10 percent of its value against the US dollar and the euro. The final amount that reached Qatar, the current custodian of the funds, it totaled 5.73 billion euros.

The US-Iran agreement to free the hostages in exchange for the funds led to criticism of the Biden administration, as many called the scheme the largest ransom payment in history.

Iran's semi-official Fars news agency has stated that Tehran envisions to boost its oil exports to Venezuela, with a target of 860,000 barrels per day within three years.

This plan involves not only exporting oil but also repairing Venezuelan refineries to facilitate this export. The goal is to restore Iran's oil exports to pre-sanctions levels, reaching 2.5 million barrels per day, amid US sanctions.

This is noteworthy given previous efforts by Iranian companies to repair Venezuelan refineries in 2020, particularly the 'Cardon' refinery, which experienced a fire shortly after repairs, and the unsuccessful overhaul of the El Palito refinery.

Iran renewed a €100 million contract for the repair of the El Palito refinery with Venezuela last year, and the facility, operating at 20% capacity, began operations in June 2023. Previously, this refinery had a daily capacity of 140,000 barrels, and it is unclear what its current capacity is.

Iranian customs statistics suggest that the equipment needed for this refinery has not been exported from Iran to Venezuela. It is likely that the Islamic Republic has purchased second-hand equipment from other countries to repair this refinery.

In recent years, Iran's non-oil exports to Venezuela have remained around $20 million annually, equivalent to less than 0.1% of Iran's total non-oil exports.

Amid serious economic isolation, the Iranian regime clings to any small and insignificant international economic deal to show audiences at home that the government is successful in fighting sanctions and instill hope that the economic crisis can be overcome. Minor deals with developing countries in Asia and Africa are trumpeted as major successes.

Iran also signed a gas condensate barter deal with Venezuelan heavy oil, starting in the fall of 2021. Data from the Commodity Intelligence Company, Kepler, indicates that Iran delivered 28 million barrels of gas condensate to Venezuela until January 2023 and bought extra-heavy crude oil from the country for resale to China.

However, since February this year, with the reduction of US oil sanctions against Venezuela, the country has not received any shipments of gas condensate from Iran. This indicates that as soon as Caracas was offered a reprieve from sanctions, it began procurement from other sources.

Iran's ambition to repair Venezuelan refineries and export crude oil to the country is significant considering its own domestic refinery challenges. Iranian refineries have experienced a 10% decline in the past decade due to insufficient maintenance and upgrades, leading to the conversion of 30% of received crude oil into mazut and bitumen, compared to just 4% in modern refineries.

For instance, Iran's largest crude oil refinery, Abadan, converts 47% of the crude oil it receives into mazut and bitumen. The operation of this refinery is, in principle, not economically viable.

Iran had agreements with South Korean and Chinese companies in the mid-2010s aimed at reducing mazut and bitumen production from refineries to 10%. However, these deals were canceled following the US withdrawal in 2018 from the Obama-era JCPOA nuclear deal, and Iran has faced challenges in modernizing and repairing its domestic power plants.

Iran’s oil exports fell from 2.2 million barrels per day in 2017, to less than 300,000 in 2019, after full US sanctions came into force. However, recently Tehran has succeeded to boost exports close to 1.8 million barrels per day, as the Biden administration has failed to enforce the sanctions. China is the main customer of Iran’s illicitly shipped crude.

Venezuela, once possessing a refining capacity of 1.3 million barrels, has seen its capacity diminish to less than 190,000 barrels per day due to refinery aging and inactivity, exacerbated by US sanctions over the past decade.

Iran's Vice President Mohammad Mokhber proposed new economic policies this week amid an ongoing national crisis.

Speaking at the 6th China International Import Expo on Sunday, Mokhber introduced six initiatives aimed at reshaping global trade patterns.

Mokhber's proposals include “the expansion of electronic trade, the establishment of international centers, and backing the development of the multilateral trade system for organizing international regulations.”

Meanwhile, at home, mounting inflation and currency devaluation continues to drive the population into worsened poverty.

As negotiations with the United States and Europe regarding Tehran's nuclear program remain unresolved and US sanctions persist, Iran is increasingly looking to Asian countries, particularly China, for trade relations. However, China has yet to significantly challenge US sanctions and has been strengthening ties with Persian Gulf Arab countries and Israel.

In March 2021, Iran entered into a controversial 25-year agreement with China, initially proposed by Iran's Supreme Leader Ali Khamenei during President Xi's visit to Tehran in 2016. Many Iranians have expressed dissatisfaction with the cooperation agreement with China, viewing it as a compromise of national interests.

Iran experiences an inflation rate of over 50 percent. The significant depreciation of the Iranian rial reflects the inflationary pressures in the country, causing increased costs for imports and, subsequently, higher prices for consumers.

While large-scale protests in 2022 primarily centered on social and political issues, the current economic crisis is fueling discontent among disillusioned youth. Labor unrest has also been on the rise in 2023 as real incomes of workers continue to erode.

An Iranian official has revealed that economic hardships coupled with the government's inattention to the demands of truck drivers, have led many to opt for emigration.

Vice President of the Association of Truck Drivers, Jalal Mousavi, drew a vivid analogy to illustrate the driving factors behind Iranian truck drivers' pursuit of opportunities abroad. He likened their emigration to Europe and Canada as a journey to paradise, shedding light on the challenges and motivations that underlie this significant trend.

Mousavi emphasized the strenuous conditions under which Iranian drivers operate within their home country, highlighting how such challenges have equipped them to face the demanding tests and requirements of European roadways. He also noted that Iranian and Pakistani drivers tend to experience higher acceptance rates when venturing overseas in pursuit of new opportunities.

During his Saturday conversation with ILNA news website in Tehran, Mousavi pointed out that “countries like Germany and Canada present more favorable conditions for the acceptance of Iranian drivers, making them appealing destinations for those seeking a better future.”

He also shared examples of government officials actively seeking to obtain commercial driving licenses, motivated by the desire to migrate for improved prospects.

Mousavi noted that the harsh economic conditions, including an overabundance of trucks and decreased cargo volume, have substantially reduced drivers' income, fueling the desire for migration.

He stressed that Iranian drivers, frequently operating aged trucks under challenging conditions, perceive emigration as a path to a brighter future.

The US House of Representatives has overwhelmingly approved a bill that aims to make it harder for Iran to sell its oil.

The legislation, known as the Stop Harboring Iranian Petroleum (SHIP) bill, was passed Friday with a vote of 342-69. It seeks to impose measures on foreign ports and refineries that handle petroleum exported from Iran in violation of US sanctions.

Iran's crude oil exports have been on the rise since 2021, after the Biden administration embarked on indirect negotiations with Tehran to revive the Obama-era JCPOA nuclear deal. Data from consultancies FGE and Vortexa shows that Iran's crude exports reached close to 2 million barrels a day, their highest level in over four years last month, with more than 80% of these exports going to China.

“They are using these funds to fund terrorism,” Rep. Mike Lawler said on CNN. “We need to impose stricter sanctions on the buyers of Iranian petroleum, starting with China.”

The SHIP Act is the latest in a long line of Congressional initiatives that target Iran. Any such initiative is effective only if the executive branch is willing to take it up and enforce it wholeheartedly –which doesn’t seem to be the case with the Biden administration.

Even if passed into law, many measures include national security waivers that grant presidents discretion in enforcing the law. And of course, China could ignore sanctions altogether, even if the US administration was willing to enforce them strictly.

Since 2021, Iran has increased its oil revenue by $80 billion.

Critics of President Biden say this money has been used by the IRGC to fund Hamas, Hezbollah and other militant groups in the region. Many at the Capitol blame the current government for turning away from Trump’s ‘maximum pressure’ policy on Iran.

“Biden Iran envoy Robert Malley helped directly fund and support Iranian intelligence,” wrote Rep. Ronny Jacjson on X. “At every turn, Biden has made Iran stronger, and has put our troops in harm’s way. Biden is the WORST president in history.”

In the last two weeks, US troops in Syria and Iraq have been attacked 27 times by Iran's militia proxy forces, despite repeated warnings from the administration, summarized in the now infamous phrase, “don’t” –which both President Biden and Vice President Harris have stated to be their message to the regime in Iran.

The Islamic Republic officials do not hesitate to boast about their support for militant groups in the region, most notably, Hamas in Gaza and Hezbollah in Lebanon.

So far, Hezbollah, by far the strongest of non-state actors in the Middle East, has avoided a full-scale conflict with Israel and has not attacked American forces.

Hezbollah leader Hassan Nasrallah said Friday that the Israel war on Hamas has spread to other fronts. He made no direct reference that could be read as a declaration of war on Israel, as some experts anticipated him to do.

He only claimed his group was ready for “all possibilities.”

Shortly before Nasrallah’s speech, the US Senate introduced a bipartisan bill aiming to enable the US Homeland Security Investigations (HSI) to enforce oil sanctions “to cut off Iran’s funding for its terrorist proxies.”

Senators Marco Rubio, a supporter of the bill who advocates a tougher stance against Iran, said Friday that “establishing credible deterrence risks escalation but failing to do so guarantees escalation.”

In a post on his X account, the Senator wrote, “Iran has now ordered 30 attacks on Americans. If the US does not impose a cost directly on Iran for these attacks, they will start coming faster.”

Iran’s oil minister Javad Owji claimed on Wednesday that the country is producing 3.4 million barrels per day (mb/d) of crude oil, about 1.2 mb/d more than in mid-2021.

In recent months, Owji has consistently reported oil production growth figures that contradict estimates from international entities.

Both OPEC and the International Energy Agency, put the country’s crude oil production at 3.1 mb/d in September, when Owji had claimed 3.3 mb/d output level for that month.

A possible reason for Owji’s exaggerated claims is repeated promises by President Ebrahim Raisi’s administration to boost the energy industry, while e its overall economic performance has remained dismal. Annual inflation hovers around 50 percent, while the government is in a race to print more money. The national currency, rial, is near its historic lows at 520,000 per US dollar.

Iran used to produce about 3.8 mb/d of crude oil as well as 650,000 b/d of gas condensate (ultralight oil) before the US imposed sanctions in 2018, when it withdrew from the Obama-era JCPOA nuclear accord and opted to put ‘maximum pressure’ on Tehran.

From the higher pre-sanction volumes, roughly 2.5 mb/d was exported and about 1.95 mb/d was consumed domestically. Currently its domestic consumption stands at 2.2 mb/d due to operational of new phases of Persian Gulf Star refinery, which refines gas condensate.

How much oil Iran produces?

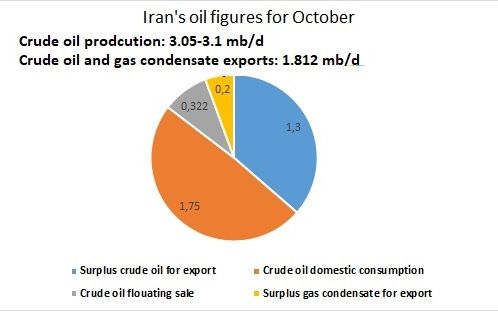

According to Kpler trade intelligence firm’s tanker tracking data, Iran’s crude oil and gas condensate exports reached 1.812 mb/d together in October, the highest since 2019 and about 370,000 b/d more than in September 2023. However, a part of this growth is due to selling its floating oil storage, not production growth.

Iran’s crude oil floating storage has declined 10 million barrels during October, or 322,000 b/d. Iran exported 1.5 mb/d of its surplus oil production as well as 322,000 b/d of flouting stockpile.

Iran had about 60 million barrels of unsold floating crude oil, stored on tankers as well 50 million barrels of gas condensate in mid-2022, but they had declined to 26 million barrels and 1 million barrels respectively as of late October 2023.

According to Oil Ministry’s official data, obtained by Iran International, the country’s 10 refineries currently consume about 1.75 mb/d of crude oil and 450,000 barrels of gas condensate (2.2 mb/d together).

As the country produces 650,000 barrels of gas condensate daily; It has 200,000 b/d of surplus to export.

If Owji’s claims are true and Iran is producing 3.4 mb/d of crude oil, then it should export its surplus 1.65 mb/d of crude oil as well as 0.2 mb/d of gas condensate.

However, as it was mentioned above, the country exported 1.812 mb/d of oil in October, including about 322,000 barrels of floating crude oil sale.

Therefore, Iran had only 1.5 mb/d of surplus crude oil and gas condensate for export in October.

It means crude oil production was about 3.1 mb/d, in line with OPEC and IEA’s estimates, not 3.4 mb/d, claimed by Owji.

Iran has still 26 million barrels of floating crude oil storage to be sold, according to Kpler.