UK Summons Iranian Envoy Over Iran International Assassination Plot

The UK foreign secretary summoned Iran's chargé d’affaires Friday, warning that Iran's "malign" activities will not be tolerated on UK soil or in the Middle East.

The UK foreign secretary summoned Iran's chargé d’affaires Friday, warning that Iran's "malign" activities will not be tolerated on UK soil or in the Middle East.

David Cameron's action followed revelations that the Iranian regime planned to assassinate two Iran International news presenters, Sima Sabet and Fardad Farahzad, in London last year.

The recently appointed foreign secretary said he wanted "to make it clear that these threats will not be tolerated", according to the Telegraph.

Over 15 Iranian threats and plots to kill British or UK-based individuals have been reported since the beginning of last year, according to government officials.

On Friday, England's Central Criminal Court sentenced a man arrested for gathering information about Iran International's London headquarters to three and a half years in prison.

Iran must be sent “an incredibly clear message that this escalation will not be tolerated,” Cameron said, citing “the threat of Iran” as one of five significant “crises” causing “extraordinarily difficult times for the world”, in addition to the Russia-Ukraine conflict, terrorism, and climate change.

The UK's tough stance follows a similar move by the US on Friday. In a clear statement, the White House stated that Iran is deeply involved in planning drone and missile attacks against commercial vessels in the Red Sea by providing intelligence to the Houthis which have blockaded the major trade route in allegiance with fellow Iran-backed militia, Hamas, in its war against Israel.

In a major development, the Pentagon said that the kamikaze drone which struck an oil tanker in the Indian Ocean early Saturday was launched directly from Iran.

The incident comes against a backdrop of Houthi attacks on commercial vessels in the Red Sea, and may suggest an escalation of regional tensions that began with the Hamas rampage of Israel on October 7 and the ensuing Israeli onslaught on Gaza.

So far, the maritime theater of conflict was confined to the Red Sea, with Iran-backed Houthis in Yemen the sole instigator.

One day before the Saturday attack, the US government accused Iran of being “deeply involved” in Houthi operations in the Red Sea. This is the first time in the recent conflict, however, that the Biden administration blames Iran for directly striking a vessel –and the first time such a strike takes place so far away from the Red Sea.

The tanker Chem Pluto was hit 200 nautical miles from the Indian coast, carrying oil from Saudi Arabia to India.

MV Cham Pluto is a Liberian-flagged, Japanese-owned vessel managed by the Netherlands’ Ace-Quantum Chemical Tankers, which is reportedly connected to the Israeli shipping tycoon Idan Ofer. And that may explain why it was selected as a target.

Some Iranian one-way “kamikaze” drones boast a range of “over 1,000 kilometers”. The one most publicized, perhaps, is Shahed 136 that has been used by Russia against Ukraine.

Iran has not yet reacted to the claim that it was behind the attack on Chem Pluto. But the regime officials have repeatedly denied involvement in the Houthi attacks.

“The resistance has its own tools of power and acts according to its decisions and capabilities,” Iran’s deputy foreign minister said Saturday in reaction to the White House claim that the regime in Tehran was "deeply involved" in planning the Houthi operations. Iran’s foreign minister repeated the counterclaim.

“We told the Americans that if we had a role, we would have declared it,” he said Saturday. “We do not have any proxy groups. These groups are real and act in line with their country's national security.”

The “kamikaze” attack on an oil tanker headed for India 200 miles off the Indian coast is a serious development, whoever the perpetrator. It could cause shipping insurance rates to go higher and ‘unsafe’ waters expand to the Indian Ocean and elsewhere, exacerbating the disruption caused by Houthi attacks in the Red Sea.

In an interview with the Telegraph on Saturday, the UK foreign secretary warned about dangers to “maritime freedom” caused by recent attacks. He said Iran must be sent “an incredibly clear message that this escalation will not be tolerated.”

Only hours earlier, the IRGC’s deputy commander had threatened that the Mediterranean Sea could be closed if the US and its allies continued to commit "crimes" in Gaza –without any suggestions as to how such a threat could be realized.

In the US, many critics of President Joe Biden say it is his reluctance to confront Iran that has emboldened the regime and its proxies in the region.

“Iran proxies, the Houthi rebels, are small in number but have all but stalled commerce in the Red Sea while we do nothing to stop them,” said former US national security advisor John Bolton on Saturday. “The mullahs in Tehran will not cooperate with our government no matter how hard Biden and Obama-era officials blindly push a return to the flawed 2015 nuclear deal to appease them.”

Congressman Mike Collins seconded the critique.

“Iran can strike civilian ships and the Biden administration will do nothing in return. Deterrence is dead,” he posted on X Saturday evening.

The CEO of the Association for the Support of Children has raised alarm over the deteriorating conditions for working children in Iran.

Noting that observations on the streets indicate a worsening situation, Tahereh Pazhouhesh emphasized that the age of child labor in Iran has now reached as low as seven years.

In a recent interview with Faraz Daily, she expressed concern that all activities related to child labor are being carried out in a negligent manner without proper supervision.

Criticizing the lack of expertise and awareness among city officials regarding children, she highlighted that, "Until specific budgetary resources are allocated for children, no changes will occur in the conditions of child labor."

In centers previously under the supervision of the Welfare Organization, Pazhouhesh disclosed that they used to care for child laborers. However, due to insufficient capacity, the government was ultimately compelled to release the children after just one week.

Meanwhile, Alireza Zakani, the Mayor of Tehran, asserted on Saturday that issues related to drug addiction and child labor would be resolved by the end of the Iranian year (March 20).

Zakani claimed that a special plan would be implemented to ensure that the face of Tehran is "completely clean" of the challenges posed by drug addiction and child labor before the Persian New Year, Nowruz.

However, Zakani's statements have triggered a wave of negative reactions from activists and social media users. Activists pointed out that child laborers are exposed to harassment and sexual abuse. Some social media users also attributed the growth of child labor, drug addiction, and homelessness to the policies of the Islamic Republic over the past four decades.

Insisting that there would be “dictatorship” in the absence of elections, Iran's Supreme Leader Saturday urged Iranians to vote in the March parliamentary elections.

Khamenei who was addressing a group of visitors from Kerman and Khuzestan provinces emphasized that the solution to the problems that Iran and Iranians are facing is participation in the elections, blaming the opposition for discouraging people from voting.

"Some people constantly remind about the country's problems to discourage people, but the solution to these problems is elections, and to solve the problems, one should participate in the elections," he said.

In his speech however, Khamenei made no mention of the actual problems highlighted by the opposition, including a serious economic crisis, rising poverty and extensive fresh corruption cases. Most notably, the 83-year-old authoritarian ruler failed to mention the controversial candidate vetting process that has consistently narrowed the circle of regime insiders in recent years, leaving most political parties and groups with no viable candidates.

Khamenei has been Supreme Leader since 1989, increasingly building his authoritarian rule, without having to get re-elected and not subject to any supervision.

"Elections are the basis of transformation. Elections prevent dictatorship, chaos, insecurity, and turbulence," he said to persuade the largely indifferent public to go to the ballot boxes.

In the jargon of the officials, including Khamenei, the word translated as turbulence, eqteshash, is always used instead of ‘protest’ when referring to anti-government manifestations.

People not loyal to the Islamic Republic were never allowed to have any political activity and have been always persecuted, but many of those who accepted the regime and even held positions in the government have been purged in the past 15 years.

Convinced that hardliners committed to Khamenei’s policies will cruise to victory with the help of the Guardian Council, which has barred most other insiders, most Iranians are showing very little interest in the upcoming elections. In addition to electing a new parliament, the March 1 vote will also select the eighty-eight clerics of the Assembly of Experts that must choose Khamenei’s successor.

Most Reformist parties and groups, as well as many among moderate conservatives, have not shown any interest in the elections given extensive candidate disqualification in the 2020 parliamentary vote, which excluded them and resulted in domination by ultra-hardliners. Many among the opposition abroad and other inside Iran staunchly oppose participation in any of the elections that the Islamic Republic holds on the grounds that voting in these circumstances would only give the regime a semblance of legitimacy.

Based on recent polls, pundits including former Reformist politician, commentator and sociologist Abbas Abdi say turnout may be the lowest in the four-decade history of the Islamic Republic. According to Abdi, less than 10 percent of the educated urban young people intend to vote and predicted that overall turnout in the capital Tehran may even be under 15 percent.

A poll recently conducted by the semi-official Iranian Students Polling Agency (ISPA), found 27.9 percent of those polled saying they would definitely vote against 36 percent who said they would not under any circumstances. 21.9 percent said they had made no decision yet.

“To what extent people hope to solve their problems through elections plays a major role in their participation,” Abdi wrote in November.

Former government spokesman, Reformist politician and sociologist Ali Rabiei has predicted that contrary to the previous elections, when interest in voting increased as voting day approached, there will be no increased interest this time. He has also predicted a turnout of around 32 percent in the country and less than half of that in Tehran.

In 2020, the Khamenei-appointed Guardian Council ensured that not only Reformists closer to conservatives, but also most moderate conservatives were excluded from the electoral lists. The vetting and low turnout resulted in the dominance of hardliners and ultra-hardliners in the current parliament.

Voter turnout in the 2020 parliamentary elections officially dropped to 42 percent, the lowest since the first elections held in 1979, only two months after the Islamic Revolution, in which 52 percent of those eligible to vote had taken part. Some critics say that even the official turnout numbers are exaggerated, and far fewer people cast ballots.

The highest turnout in the parliamentary elections was registered in 2001, during the presidency of Reformist Mohammad Khatami, when 67 percent of eligible voters went to the polls. This was one of the rare occasions when the Guardian Council allowed candidates from across the political spectrum loyal to the regime to run. Reformists gained an overwhelming majority in the 2001 elections.

In a recent disclosure, a member of the Iranian parliament, has revealed that the upcoming year's budget includes approval for a potential increase in energy prices.

Jalal Mahmoudzadeh has sounded a note of caution, emphasizing that the approval carries a risk, “as the government may suddenly decide to raise the prices of gasoline or other energy carriers."

Despite assurances from Iran's Oil Minister, Javad Owji, and government spokesman Ali Bahadori Jahromi that there are no plans to increase gasoline prices, a sense of skepticism prevails among many Iranians. There is a widespread belief that the government is deferring a price hike. In late July, Iran International reported that the government postponed the implementation of stricter fuel rationing for political reasons.

In November 2019 nationwide protests were triggered by a fuel price increase, resulting in a brutal crackdown and the tragic death of at least 1,500 civilians.

Since at least mid-2022, Iran has been contending with gasoline shortages, leading to the release of one-third of its strategic reserves. Despite being a global powerhouse in oil and gas reserves, the government continues to sell gasoline at highly subsidized prices, charging less than 10 US cents per gallon or less than 3 cents per liter. Neighboring oil-producing nations align their prices more closely with international market rates. Iran boasts the world's second-cheapest gasoline price, surpassed only by Venezuela.

Discussions about adjusting prices have been ongoing for years, but the economic crisis since 2018, marked by a 12-fold drop in Iran's currency, requires a substantial increase to have a meaningful impact in US dollars. The hesitation to raise prices during the current economic turmoil is further complicated by the severe unrest faced by the Islamic Republic from September 2022 to February 2023.

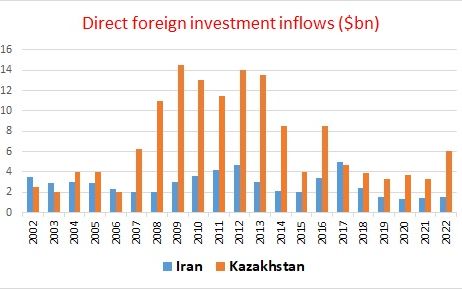

As Iran grapples with a severe lack of foreign investment, its Arab neighbors are increasingly channeling funds into Iran's northern regions, boosting trade turnover.

On December 17, the United Arab Emirates and the Republic of Azerbaijan jointly launched a substantial investment fund worth one billion dollars. This collaborative venture sees the Azerbaijan Investment Holding and the Abu Dhabi Investment Company each holding a 50% stake in the fund. The primary focus of their investments will revolve around clean energy, agriculture, pharmaceuticals, and technology, encompassing Azerbaijan, the UAE, and Central Asia.

In recent years, Gulf Cooperation Council (GCC) members, particularly Saudi Arabia and the United Arab Emirates, have signed investment agreements totaling nearly $30 billion with the Republic of Azerbaijan and four Turkic-speaking Central Asian nations, including Turkmenistan, Uzbekistan, Kazakhstan, and Kyrgyzstan. These agreements have significantly bolstered trade relations between the Arab states and these countries, with a notable emphasis on non-oil products and substantial investments directed toward clean energy initiatives.

GCC And Azerbaijan

Emirates-based company "Masdar" unveiled a $262 million, 230-megawatt solar power plant in the Republic of Azerbaijan just two months ago. Simultaneously, Masdar signed contracts for the construction of three solar and wind power firms, boasting a combined capacity of one gigawatt, all within Azerbaijan.

Joining the renewable energy endeavors in Azerbaijan, French Total and British BP, along with Saudi's "Acwa Power," are currently investing $290 million to establish a 230-megawatt wind power plant. Furthermore, these companies inked two significant agreements this spring to generate 2,500 megawatts of wind and solar power, both on land and at sea, in collaboration with the Republic of Azerbaijan.

All these investments take place as Iran suffers from energy shortages and its renewable energy sector remains seriously under-developed.

Azerbaijan's contracts with Total and Acwa Power also include large electricity storage facilities, allowing the country to save and provide a significant amount of electricity for sale at much higher prices to foreign customers during peak consumption periods.

Azerbaijan has adopted a similar approach in its natural gas trade strategy. The nation has developed underground gas storage facilities and expanded its gas storage capacity to 3.5 billion cubic meters. During the summer, Azerbaijan injects surplus gas from Turkmenistan, received through Iran, into these storage facilities. Then, during the winter months, it re-extracts and exports this gas at considerably higher prices.

Abu Dhabi National Oil Company (ADNOC) has also entered the Azerbaijani energy sector by acquiring a 30% stake in the Absheron gas field, located in the Caspian Sea's Azerbaijani sector. While the first phase of this gas field, operated by Total, commenced operations this year, the second phase is scheduled to be operational by 2027. Upon full operation, the gas field will annually produce six billion cubic meters of gas destined for European markets.

Baku has ambitious plans to double its natural gas exports to Europe within the next three years. In a recent development, the country initiated gas sales to its seventh customer, Serbia. Currently, Georgia, Turkey, Greece, Italy, Romania, Bulgaria, and Serbia are all recipients of Azerbaijani gas, collectively importing 22 billion cubic meters of gas from Azerbaijan in the first 11 months of this year.

The revenue from Azerbaijani gas exports surpassed that of oil exports for the first time last year. The nation also has its sights set on substantial growth in electricity exports.

Azerbaijan aims to launch approximately 10,000 megawatts of renewable power plants by 2030, equivalent to ten times the electricity generation capacity of Iran's Bushehr nuclear power plant. A significant portion of this electricity will be exported to Europe. Notably, last year, Azerbaijan exported over three terawatt-hours of electricity, three times more than Iran's net electricity exports. A massive undersea cable installation project is underway, spanning 1,100 kilometers across the Black Sea from Georgia to the Baltic region. This initiative marks the beginning of Azerbaijan's electricity exports to Europe via Georgia.

Trade relations between the Republic of Azerbaijan and Saudi Arabia, as well as the United Arab Emirates, have experienced a fivefold and 2.5-fold increase, respectively, over the past three years. Importantly, a substantial portion of this trade involves non-oil commodities.

GCC And Central Asia

In the broader context of the Gulf Cooperation Council (GCC) and Central Asia, the United Arab Emirates and Saudi Arabia have collectively signed investment agreements exceeding $20 billion with four Turkic-speaking Central Asian countries, including Turkmenistan, Uzbekistan, Kazakhstan, and Kyrgyzstan. Additionally, Qatar and Oman have recently penned new investment memoranda with these nations.

The vast assets of GCC investment funds and national wealth, amounting to a staggering $4 trillion, have enabled these countries to embark on the establishment of innovative indigenous companies. This has facilitated the integration of modern Western technologies, leading to a significant influx of foreign projects.

For years, the UAE's Dragon Oil has held the exclusive development rights for Turkmenistan offshore oil and gas fields, exporting the produced oil to European markets through the Republic of Azerbaijan. Last year, the company signed a new billion-dollar contract with Turkmenistan and committed to investing $8 billion in new oil and gas fields over the next 15 years.

The UAE has invested seven billion dollars in Kazakhstan and Uzbekistan, part of which involves the development of a thousand megawatts of solar and wind power plants by the UAE's Masdar company. Qatar also signed a joint investment fund with an initial asset of $100 million, along with a commitment to invest in projects worth $1.2 billion in Kyrgyzstan.

The UAE also holds a 51-percent share in the Khorgos Customs in Kazakhstan in collaboration with China, and a 49% share in the Aktau Seaport in the Caspian Sea. Additionally, Saudi Arabia's Acwa Power has signed contracts worth $13.5 billion with Kazakhstan and Uzbekistan for the development of clean energy, including solar and wind, converting fossil fuels into clean hydrogen, and more.

During a meeting held in June that brought together leaders from the GCC and Central Asian countries, the Abu Dhabi National Energy Company announced a $3 billion investment agreement with Uzbekistan, focused on thermal power plants. In the same gathering, Qatar also committed to a $12 billion investment in Uzbekistan.

As these developments unfold, Oman and Kuwait are engaged in preliminary agreements for new investments in Central Asian nations. Currently, Oman holds a 20% stake in the Zhemchuzhina and Dunga oil fields located in Kazakhstan.

Iran, Northern Neighbors Relations

In contrast, Iran's financial relations with its northern neighbors revolve solely around trade, without the inclusion of joint investment projects, investment funds, and similar endeavors. This limitation is primarily attributed to political tensions between Iran and its neighboring states, as well as the impact of international sanctions.

In contrast, Iran's financial relations with its northern neighbors revolve solely around trade, without the inclusion of joint investment projects, investment funds, and similar endeavors. This limitation is primarily attributed to political tensions between Iran and its neighboring states, as well as the impact of international sanctions.

However, when it comes to Central Asia and the Caucasus, these eight countries collectively account for less than 4% of Iran's foreign trade. Despite shared religious, cultural, and linguistic ties, the intricate nature of Iran's economic relationship with these nations becomes evident.

In 2022, Iran's trade volume with Central Asian countries demonstrated significant growth, though it still comprised less than 2% of the nation's total foreign trade. Trade with Kyrgyzstan and Tajikistan, for instance, reached approximately $170 million. Furthermore, the trade volume between Kazakhstan and Iran witnessed a 20% increase compared to the previous year, totaling $528 million.

Iran currently occupies a limited geopolitical position in Central Asia, despite its advantageous geographic location and long-standing historical connections with the region. The rising investments from Saudi Arabia, the United Arab Emirates, and other Gulf Cooperation Council (GCC) countries further complicate the existing intricate dynamics. To remain relevant and assert its influence in Central Asia, Iran must recalibrate its regional policy, addressing diplomatic tensions, particularly with neighbors like Azerbaijan, and nurturing an environment conducive to enhanced economic collaboration. A proactive approach, involving the strengthening of economic ties, leveraging cultural affinities, and engaging in constructive dialogues, will be essential for Iran's continued significance amid the evolving dynamics of the region.