Iranian Cleric Condemns Peer Filming Unveiled Woman

A senior Iranian cleric has voiced criticism over a video circulating on social media depicting a fellow cleric filming an unveiled woman in a clinic in Qom, Iran's holy city.

A senior Iranian cleric has voiced criticism over a video circulating on social media depicting a fellow cleric filming an unveiled woman in a clinic in Qom, Iran's holy city.

Mohammad-Taghi Fazel Meibodi, a member of the Assembly of Qom Seminary Scholars and Researchers, condemned the behavior, stating that “such conduct is inappropriate for someone in clerical attire.”

Meibodi emphasized the need to avoid escalating tensions, warning that such incidents could reignite civil protests. His comments allude to the recent surge in public discontent, particularly following the death of Mahsa Amini, who was arrested in 2022 for not wearing proper hijab, sparking the Woman, Life, Freedom movement across Iran.

The video, which went viral in Iran, captures a tense encounter between a cleric and a young woman holding her baby in the clinic. The woman's hijab is loose, prompting the cleric to film her, in accordance with the clerical regime's policy of enforcing proper hijab. Instances of hardliners reporting others for insufficient hijab are common, often resulting in legal action by authorities.

The situation escalated into a confrontation when the woman noticed the cleric filming her. Other women in the clinic intervened, urging the cleric to delete the video to avoid further trouble for the mother.

The incident highlights broader issues surrounding women's rights and the enforcement of hijab laws in Iran. Rather than prosecuting those who harass others over hijab, authorities often target victims and those who share photos or videos that portray the regime or its officials negatively.

Despite growing criticism and calls for reform, Mehdi Rostamnejad, deputy for education at the seminaries, on Monday claimed an increase in applicants for seminary education, alleging continued interest in religious studies despite recent controversies.

This week, US President Joe Biden is confronted with a critical decision regarding a $10 billion sanctions waiver for Iran – and whether to renew it, or not.

With the ongoing war in Gaza and continued attacks by the Iran-backed Houthis in the Red Sea, the deadline could not come at a worse moment for the administration.

Last year, the US extended the sanctions waiver by four months, allowing Iraq to continue purchasing electricity from Iran.

Additionally, the waiver granted Iran limited access to approximately $10 billion in Iraqi payments held in escrow accounts, ostensibly for purchasing "humanitarian goods" without facing US sanctions.

However, both Republicans and Democrats swiftly challenged this decision, contending that the fungibility of money would effectively empower the Tehran regime to divert these funds towards arming its proxies, despite the humanitarian guise.

As of today, details of Iran's utilization of the sanctions-waived funds remain largely unclear.

During a December 2023 hearing of the House Financial Services Committee, Elizabeth Rosenberg, the assistant secretary of the US Treasury Department, acknowledged the existence of "two transactions” by Iran.

She added that she would only provide additional detail about those transactions in a classified setting.

If the administration’s plan was to keep the region – and Iran – quiet until after the 2024 US election – the recent developments have proven that plan to have backfired.

Middle East Unrest Intensifies After Waiver Decision

Since the US extended the sanctions waiver four months ago, the situation in the Middle East has deteriorated further, amplifying an already tense crisis.

In January, an Iran-backed militia's drone attack in Jordan claimed the lives of three US service members, marking the first American military fatalities from hostile fire amid escalating tensions from Israel's conflict with Hamas.

Increased attacks on vessels in the Red Sea by Iran-backed Houthi rebels have intensified criticism of the administration's handling of Iran. Last week, CENTCOM Commander Gen. Erik Kurilla told the Senate Armed Services Committee that Iran remains undeterred in its support for Hamas, Hezbollah and the Houthis – and is not paying a price for its nefarious activities in the region.

“In light of these things, it is shocking that the US would then permit tyrants and extremists in Tehran access to billions of dollars which will undoubtedly be used to wreak havoc on America and its allies - including Israel,” Dr. Casey Babb, International Fellow with the Institute for National Security Studies in Tel Aviv, told Iran International.

The international security and affairs expert maintains that Iran is to blame for much of the region’s turmoil – and the Biden administration, along with most Western governments “don't seem to have any idea what they're doing…the lack of foresight and strategic decision-making in the region is astounding, and the potential unfreezing of additional money for Iran speaks to this”.

The presence of Iran’s Vice President at the annual meeting of the United Nations Commission on the Status of Women has sparked controversy in light of the regime's systemic oppression of women and girls.

Ensieh Khazali arrived in New York on Sunday amid Iran's dismal human rights record, including its treatment of women and suppression of dissent.

Khazali's agenda at the UN summit is to highlight the plight of Palestinian women in Gaza but in the light of Iran's oppression of women and girls, the move has drawn widespread criticism, with activists condemning the US State Department for granting Khazali a visa despite Iran's human rights violations.

Critics argue that granting a visa to Khazali, who has been implicated in supporting oppressive policies such as child marriage, undermines the principles of human rights and sends the wrong message to Tehran amid wider criticism of the Biden administration for being too lenient on the regime.

The death of Mahsa Amini in morality policy custody in 2022 sparked international outrage and protests, shedding light on the brutality of Iran's religious police and the systemic violence inflicted on women in the country.

It was last year that former VICE correspondent Isobel Yeung and her crew faced a harrowing ordeal just one day after conducting a challenging interview with Ensieh Khazali in Tehran. They were held at gunpoint by Iran's security forces, forced to surrender their footage and belongings, and subsequently instructed to leave the country.

"We found our van suddenly surrounded by a team of Iran's security forces. A gun was held to our head, and everything was taken from us. Later that night while in detention, they told us they suspected we were working under false pretenses. The next day we were instructed to leave the country," she recalled in her report from Iran.

Power cuts in industrial units in Iran have sparked concerns among manufacturers, leading to a downturn in production and a surge in overall costs.

According to a report by the Iranian Labour News Agency (ILNA), the electricity production capacity in the northern province of Golestan stands at 1500 megawatts. However, more than 600 megawatts of electricity needed by Golestan are sourced from other provinces due to shortages.

Voltage fluctuations and power outages have become recurring issues for both citizens and manufacturers, compounding the challenges faced by businesses.

Earlier statements from Iranian officials have highlighted the country's dwindling net electricity exports, which have now reached zero due to internal deficits. Official data indicates a gradual decline in electricity exports over the past three years, coupled with an increase in imports.

A decade ago, Iran boasted net electricity exports of 8 terawatt-hours (TWh). However, the figure plummeted to just over 1 TWh last year and has now hit rock bottom.

Several factors contribute to the decline in electricity exports. High domestic consumption persists as the government maintains low electricity prices through a long-standing subsidy program, fearing public backlash if prices were adjusted.

Additionally, inefficiencies within the government-controlled economy exacerbate mismanagement and hinder sectoral growth. Years of foreign sanctions have also taken their toll on Iran's energy infrastructure.

Iran has struggled to meet its electricity generation growth targets in recent years, facing a shortfall of 14 megawatts (MW) during peak summer demand.

As Qatar sets higher ambitions for its gas output, Iranian officials scramble to justify their under-performance in developing the South Pars field, resorting to statistical maneuvers to deflect criticism.

Sakhavat Asadi, the chief executive of Iran’s Pars Special Economic Zone Organization, has claimed that Iran's natural gas production from the joint Persian Gulf South Pars gas field (called North Dome by Qatar) surpasses that of Qatar's. He boasted of Iran's daily gas output from the field reaching a staggering 700 million cubic meters daily (mcm/d).

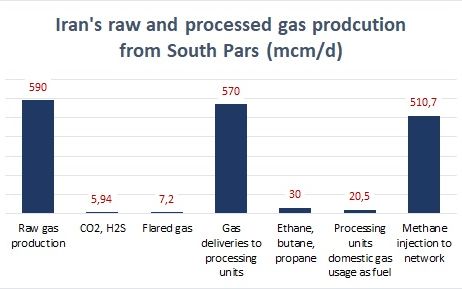

However, a report from the Iran National Gas Company, obtained by Iran International, presents a different perspective. It reveals that Iran extracted approximately 590 mcm/d of raw gases from South Pars during the first half of 2023, of which only 510 mcm/d of natural gas (methane) were injected into the network after processing.

Additionally, alongside 30 mcm/d of ethane, butane, propane, and other gases, approximately 6 mcm/d of the extracted raw gas comprised toxic gases like CO2 and H2S. Moreover, more than 7 mcm/d of the output is flared and wasted during the extraction and gas purification process, while 20.5 mcm/d is consumed directly in gas processing units as fuel.

However, in official statistics Iran insists that it produced 657 million cubic meters per day (mcm/d) of processed gas from all fields during the last fiscal year, beginning March 22, 2023, with approximately 78% (512 mcm/d) originating from South Pars.

Iran’s Oil Minister, Javad Owji, asserted last week during the Gas Exporting Countries Forum in Algeria that Iran is presently generating 1.07 billion cubic meters per day (bcm/d) of gas and aims to increase this volume to 1.3 bcm/d within five years through a $70 billion investment plan. However, his claim of a 40% overstatement in the current gas production level and the $70 billion investment plan in gas fields seem dubious, given that Iran's annual investment in upstream oil and gas fields averaged only $3 billion in recent years.

First international and then US sanctions in the past 15 years have not only handicapped Iran’s investment capabilities but also access to Western technology, which are imperative for expanding production at the South Pars field.

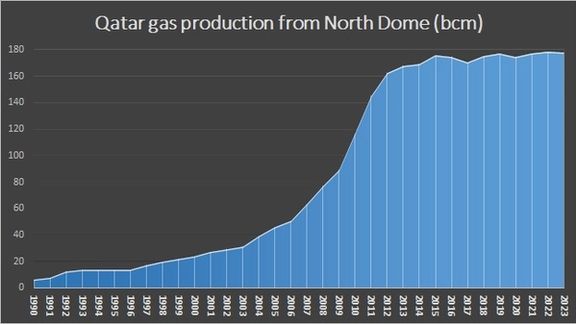

Qatar has been extracting gas from South Pars since 1990, a decade ahead of Iran, and has produced nearly double the amount of gas from the field. Despite this, Iran launched 14 new phases during the last decade and only recently reached Qatar’s production level.

In 2005, Qatar declared a moratorium on the development of the North Dome field to study the impact of rapid output increases on the reservoir. However, development resumed in 2022, with Qatar sealing $29 billion worth of agreements with Western companies to boost production by 30% by 2026, aiming to increase annual LNG export capacity from 77 million tons (110 bcm/yr) to 126 million tons per annum (mtpa) and projected to reach 142 mtpa by 2030. Consequently, Qatar's total gas production from South Pars is expected to reach 740 mcm/d by 2030, while Iran’s production from this joint field is forecasted to decline by over 30% in a decade, dropping to approximately 350 mcm/d due to pressure fall on the Iranian side.

The Challenge of Pressure Decline and Engineering Mishaps

While Iran has recently caught up to Qatar's daily production levels, the Iranian sector of South Pars is grappling with declining pressure. An assessment from the Iran National Development Fund suggests that a quarter of the country’s total gas production is expected to decrease by 2033 due to declining pressure in South Pars, which accounts for 78% of the country’s total gas production.

To stave off production decline, Iran faces the daunting task of installing 10 to 15 platforms, each weighing 20,000 tons—15 times the size of current platforms—equipped with massive compressors. This venture is estimated to cost a staggering $35 billion. Meanwhile, Qatar made strides in this direction years ago.

Meanwhile, Iran's Oil Ministry inked a $20-billion deal with several domestic companies on March 10 to construct 28 platforms weighing 7,000 tons each, along with 56 compressors for the pressure-boosting initiative at South Pars. This decision comes despite the lack of experience among Iranian firms in manufacturing such equipment, and even Chinese companies are not equipped with the necessary technology. Chinese CNPC, previously part of the Total-led South Pars Phase 11 development consortium, withdrew from the deal a year after Total. Notably, half of the $5-billion contract value for the South Pars Phase 11 development was attributed to building a 20,000-ton platform with two massive compressors, a task exceeding the capabilities and technological expertise of the Chinese company.

Until recently, the wellhead pressure in the Iranian sector of South Pars remained steady at an average of 210 bars. However, since 2023, its pressure has started declining by 7 bars annually, resulting in a loss of 10 bcm each year. Significant pressure fall in Phase 12, the largest phase of South Pars, has already begun in recent years, with output levels declining from 65 mcm/d in 2018 to the current 43 mcm/d, according to a report from the National Iranian Gas Company, as seen by Iran International.

Iran had ambitious plans to produce 85 mcm/d of gas from Phase 12 by launching three platforms. However, due to erroneous drilling engineering at the location of the third platform, a substantial portion of its production turned out to be brackish water instead of natural gas. Consequently, production from this phase was slashed to 65 mcm in 2018 and dropped to 34% in 2023. Ultimately, Iran relocated the third platform from Phase 12 entirely to Phase 11 of South Pars last summer.

Across the 24 phases constituting the Iranian section of South Pars, approximately 10 wells have encountered engineering mishaps, resulting in the production of more brackish water than gas. In an effort to salvage production levels, Iran initiated Phase 11 of South Pars in August 2023 and launched a drilling spree. Additionally, the Iranian Ministry of Petroleum inked a deal in November 2023 to drill 35 new wells with domestic companies. However, while additional drilling may sustain gas production levels from South Pars in the short term, it is anticipated to hasten pressure decline in the Iranian section.

Iran's only recourse lies in the installation of 20,000-ton platforms equipped with massive compressors—a technology monopolized by Western companies. Currently, all 24 phases of the Iranian side of the field are operational, leaving no room for the introduction of a new phase to bolster production or offset output declines from other phases.

South Pars Field

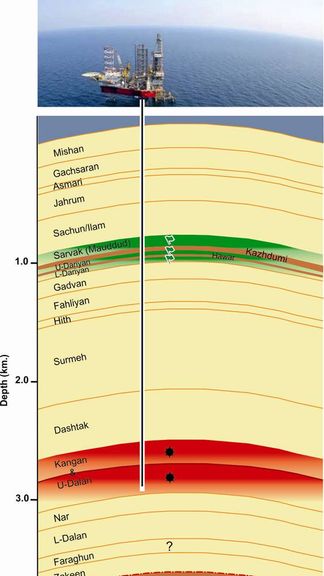

Stretching across an immense expanse of 56 trillion cubic meters, South Pars—also referred to as North Dome in Qatar—houses vast gas reserves, 70% of which are deemed recoverable. While two-thirds of the field lie within Qatari waters, the remaining third is situated within Iranian territory. To date, Iran has extracted 2 trillion cubic meters of gas from this field, equivalent to half of Qatar’s current production. The gas-rich Kangan and U-Dalan formations, known as the Khuff formation in Qatar, are nestled at a depth of approximately 3 kilometers. Comprising four layers (K1 to K4) with a thickness of 450 meters, these formations stretch from Iranian to Qatari waters.

Noteworthy is the inclination of this reservoir towards Qatar, with the flow of gas and gas condensates gravitating predominantly towards Qatar from Iran. Both countries are currently producing 650,000 to 700,000 barrels of gas condensate (ultra-light oil) daily from these four layers. Interestingly, Qatar's total gas condensate production volume over the last three decades has been double that of Iran's.

As Qatar's production from this reservoir continues to rise and Iran's output diminishes, the gas reserves of this formation are projected to gradually shift towards Qatar. Additionally, situated at a depth of one kilometer, this field harbors multiple layers of crude oil stretching from Iran to Qatar, making it a shared asset between the two nations.

Qatar commenced crude oil production from the oil layers of South Pars three decades ago, while Iran began tapping into these layers in limited capacities only since 2016. Conversely, while Iran allows extracted helium to dissipate and go to waste, Qatar has implemented the necessary equipment to capture and process this valuable gas since 2006. Currently, Qatar accounts for 35% of the world’s helium production and leads in terms of export volume, having exported 66 million cubic meters of helium in 2023.

MP Jabar Kouchakinejad warned that the latest boycott of Iran’s elections will impact future polls as the government struggles to retain credibility.

Kouchakinejad, who was elected as the MP of the northern city of Rasht, attributed the decline in voter turnout to the perceived misconduct of government officials and parliamentarians.

“If not addressed promptly, the trend could pose significant challenges in the forthcoming 2025 presidential elections,” he cautioned in his Monday interview with Rouydad 24.

Rasht, Kuchakinejad's electoral district, recorded the lowest voter turnout nationwide on March 1, standing at a mere 22%.

“The lack of public participation, coupled with instances of casting blank or invalid votes, reflects a broader discontent with the performance of government officials,” he added.

He further expressed disappointment in the failure of officials to address public concerns adequately.

"We officials neither behaved well with the people nor solved their problems; we should have at least done one of these properly to prevent the bitter incident of people's non-participation," Kuchakinejad stated.

Echoing his concerns, Emad al-Din Baghi, a prominent reformist activist, estimated that only about 20% of voters were happy with the current situation and took part in March 1 elections. Baqi urged authorities to heed the significance of the figures and undertake necessary reforms to restore public trust in the electoral process.

Furthermore, Baqi raised doubts about the accuracy of the government's official turnout figures, suggesting that “closer examination reveals a truer participation rate of around 34%, taking into account invalid votes.”