Power Cuts Exacerbate Manufacturing Woes Amid Iran's Electricity Crisis

Power cuts in industrial units in Iran have sparked concerns among manufacturers, leading to a downturn in production and a surge in overall costs.

Power cuts in industrial units in Iran have sparked concerns among manufacturers, leading to a downturn in production and a surge in overall costs.

According to a report by the Iranian Labour News Agency (ILNA), the electricity production capacity in the northern province of Golestan stands at 1500 megawatts. However, more than 600 megawatts of electricity needed by Golestan are sourced from other provinces due to shortages.

Voltage fluctuations and power outages have become recurring issues for both citizens and manufacturers, compounding the challenges faced by businesses.

Earlier statements from Iranian officials have highlighted the country's dwindling net electricity exports, which have now reached zero due to internal deficits. Official data indicates a gradual decline in electricity exports over the past three years, coupled with an increase in imports.

A decade ago, Iran boasted net electricity exports of 8 terawatt-hours (TWh). However, the figure plummeted to just over 1 TWh last year and has now hit rock bottom.

Several factors contribute to the decline in electricity exports. High domestic consumption persists as the government maintains low electricity prices through a long-standing subsidy program, fearing public backlash if prices were adjusted.

Additionally, inefficiencies within the government-controlled economy exacerbate mismanagement and hinder sectoral growth. Years of foreign sanctions have also taken their toll on Iran's energy infrastructure.

Iran has struggled to meet its electricity generation growth targets in recent years, facing a shortfall of 14 megawatts (MW) during peak summer demand.

As Qatar sets higher ambitions for its gas output, Iranian officials scramble to justify their under-performance in developing the South Pars field, resorting to statistical maneuvers to deflect criticism.

Sakhavat Asadi, the chief executive of Iran’s Pars Special Economic Zone Organization, has claimed that Iran's natural gas production from the joint Persian Gulf South Pars gas field (called North Dome by Qatar) surpasses that of Qatar's. He boasted of Iran's daily gas output from the field reaching a staggering 700 million cubic meters daily (mcm/d).

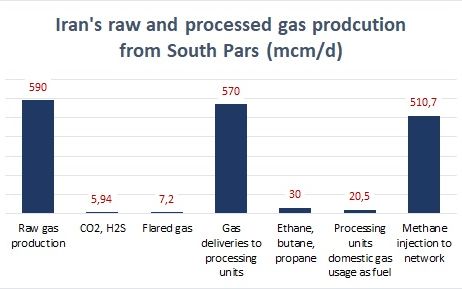

However, a report from the Iran National Gas Company, obtained by Iran International, presents a different perspective. It reveals that Iran extracted approximately 590 mcm/d of raw gases from South Pars during the first half of 2023, of which only 510 mcm/d of natural gas (methane) were injected into the network after processing.

Additionally, alongside 30 mcm/d of ethane, butane, propane, and other gases, approximately 6 mcm/d of the extracted raw gas comprised toxic gases like CO2 and H2S. Moreover, more than 7 mcm/d of the output is flared and wasted during the extraction and gas purification process, while 20.5 mcm/d is consumed directly in gas processing units as fuel.

However, in official statistics Iran insists that it produced 657 million cubic meters per day (mcm/d) of processed gas from all fields during the last fiscal year, beginning March 22, 2023, with approximately 78% (512 mcm/d) originating from South Pars.

Iran’s Oil Minister, Javad Owji, asserted last week during the Gas Exporting Countries Forum in Algeria that Iran is presently generating 1.07 billion cubic meters per day (bcm/d) of gas and aims to increase this volume to 1.3 bcm/d within five years through a $70 billion investment plan. However, his claim of a 40% overstatement in the current gas production level and the $70 billion investment plan in gas fields seem dubious, given that Iran's annual investment in upstream oil and gas fields averaged only $3 billion in recent years.

First international and then US sanctions in the past 15 years have not only handicapped Iran’s investment capabilities but also access to Western technology, which are imperative for expanding production at the South Pars field.

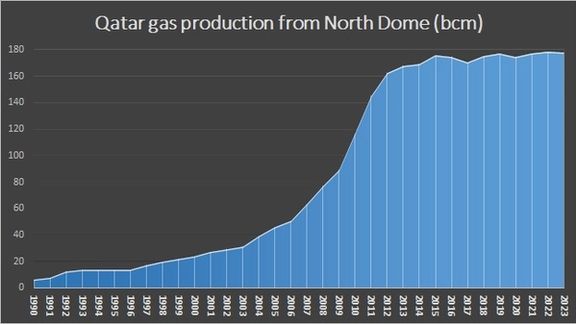

Qatar has been extracting gas from South Pars since 1990, a decade ahead of Iran, and has produced nearly double the amount of gas from the field. Despite this, Iran launched 14 new phases during the last decade and only recently reached Qatar’s production level.

In 2005, Qatar declared a moratorium on the development of the North Dome field to study the impact of rapid output increases on the reservoir. However, development resumed in 2022, with Qatar sealing $29 billion worth of agreements with Western companies to boost production by 30% by 2026, aiming to increase annual LNG export capacity from 77 million tons (110 bcm/yr) to 126 million tons per annum (mtpa) and projected to reach 142 mtpa by 2030. Consequently, Qatar's total gas production from South Pars is expected to reach 740 mcm/d by 2030, while Iran’s production from this joint field is forecasted to decline by over 30% in a decade, dropping to approximately 350 mcm/d due to pressure fall on the Iranian side.

The Challenge of Pressure Decline and Engineering Mishaps

While Iran has recently caught up to Qatar's daily production levels, the Iranian sector of South Pars is grappling with declining pressure. An assessment from the Iran National Development Fund suggests that a quarter of the country’s total gas production is expected to decrease by 2033 due to declining pressure in South Pars, which accounts for 78% of the country’s total gas production.

To stave off production decline, Iran faces the daunting task of installing 10 to 15 platforms, each weighing 20,000 tons—15 times the size of current platforms—equipped with massive compressors. This venture is estimated to cost a staggering $35 billion. Meanwhile, Qatar made strides in this direction years ago.

Meanwhile, Iran's Oil Ministry inked a $20-billion deal with several domestic companies on March 10 to construct 28 platforms weighing 7,000 tons each, along with 56 compressors for the pressure-boosting initiative at South Pars. This decision comes despite the lack of experience among Iranian firms in manufacturing such equipment, and even Chinese companies are not equipped with the necessary technology. Chinese CNPC, previously part of the Total-led South Pars Phase 11 development consortium, withdrew from the deal a year after Total. Notably, half of the $5-billion contract value for the South Pars Phase 11 development was attributed to building a 20,000-ton platform with two massive compressors, a task exceeding the capabilities and technological expertise of the Chinese company.

Until recently, the wellhead pressure in the Iranian sector of South Pars remained steady at an average of 210 bars. However, since 2023, its pressure has started declining by 7 bars annually, resulting in a loss of 10 bcm each year. Significant pressure fall in Phase 12, the largest phase of South Pars, has already begun in recent years, with output levels declining from 65 mcm/d in 2018 to the current 43 mcm/d, according to a report from the National Iranian Gas Company, as seen by Iran International.

Iran had ambitious plans to produce 85 mcm/d of gas from Phase 12 by launching three platforms. However, due to erroneous drilling engineering at the location of the third platform, a substantial portion of its production turned out to be brackish water instead of natural gas. Consequently, production from this phase was slashed to 65 mcm in 2018 and dropped to 34% in 2023. Ultimately, Iran relocated the third platform from Phase 12 entirely to Phase 11 of South Pars last summer.

Across the 24 phases constituting the Iranian section of South Pars, approximately 10 wells have encountered engineering mishaps, resulting in the production of more brackish water than gas. In an effort to salvage production levels, Iran initiated Phase 11 of South Pars in August 2023 and launched a drilling spree. Additionally, the Iranian Ministry of Petroleum inked a deal in November 2023 to drill 35 new wells with domestic companies. However, while additional drilling may sustain gas production levels from South Pars in the short term, it is anticipated to hasten pressure decline in the Iranian section.

Iran's only recourse lies in the installation of 20,000-ton platforms equipped with massive compressors—a technology monopolized by Western companies. Currently, all 24 phases of the Iranian side of the field are operational, leaving no room for the introduction of a new phase to bolster production or offset output declines from other phases.

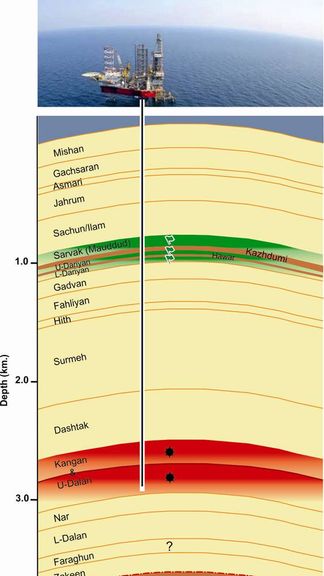

South Pars Field

Stretching across an immense expanse of 56 trillion cubic meters, South Pars—also referred to as North Dome in Qatar—houses vast gas reserves, 70% of which are deemed recoverable. While two-thirds of the field lie within Qatari waters, the remaining third is situated within Iranian territory. To date, Iran has extracted 2 trillion cubic meters of gas from this field, equivalent to half of Qatar’s current production. The gas-rich Kangan and U-Dalan formations, known as the Khuff formation in Qatar, are nestled at a depth of approximately 3 kilometers. Comprising four layers (K1 to K4) with a thickness of 450 meters, these formations stretch from Iranian to Qatari waters.

Noteworthy is the inclination of this reservoir towards Qatar, with the flow of gas and gas condensates gravitating predominantly towards Qatar from Iran. Both countries are currently producing 650,000 to 700,000 barrels of gas condensate (ultra-light oil) daily from these four layers. Interestingly, Qatar's total gas condensate production volume over the last three decades has been double that of Iran's.

As Qatar's production from this reservoir continues to rise and Iran's output diminishes, the gas reserves of this formation are projected to gradually shift towards Qatar. Additionally, situated at a depth of one kilometer, this field harbors multiple layers of crude oil stretching from Iran to Qatar, making it a shared asset between the two nations.

Qatar commenced crude oil production from the oil layers of South Pars three decades ago, while Iran began tapping into these layers in limited capacities only since 2016. Conversely, while Iran allows extracted helium to dissipate and go to waste, Qatar has implemented the necessary equipment to capture and process this valuable gas since 2006. Currently, Qatar accounts for 35% of the world’s helium production and leads in terms of export volume, having exported 66 million cubic meters of helium in 2023.

MP Jabar Kouchakinejad warned that the latest boycott of Iran’s elections will impact future polls as the government struggles to retain credibility.

Kouchakinejad, who was elected as the MP of the northern city of Rasht, attributed the decline in voter turnout to the perceived misconduct of government officials and parliamentarians.

“If not addressed promptly, the trend could pose significant challenges in the forthcoming 2025 presidential elections,” he cautioned in his Monday interview with Rouydad 24.

Rasht, Kuchakinejad's electoral district, recorded the lowest voter turnout nationwide on March 1, standing at a mere 22%.

“The lack of public participation, coupled with instances of casting blank or invalid votes, reflects a broader discontent with the performance of government officials,” he added.

He further expressed disappointment in the failure of officials to address public concerns adequately.

"We officials neither behaved well with the people nor solved their problems; we should have at least done one of these properly to prevent the bitter incident of people's non-participation," Kuchakinejad stated.

Echoing his concerns, Emad al-Din Baghi, a prominent reformist activist, estimated that only about 20% of voters were happy with the current situation and took part in March 1 elections. Baqi urged authorities to heed the significance of the figures and undertake necessary reforms to restore public trust in the electoral process.

Furthermore, Baqi raised doubts about the accuracy of the government's official turnout figures, suggesting that “closer examination reveals a truer participation rate of around 34%, taking into account invalid votes.”

Anisa Fanaiyan, an Iranian Baha'i has been sentenced to 16 years in prison and fined 500 million rials (approximately $850) by the Semnan Revolutionary Court.

Additionally, Fanaiyan has been deprived of social rights for 15 years and faces a two-year prohibition from joining political and social groups.

The court verdict states that Fanaiyan has been sentenced to 10 years in prison for "establishing and managing a group with the intention of undermining national security," five years for "deviant educational and propagandistic activities contrary to Islamic law," and one year of probation for "propaganda against the Islamic Republic system."

Furthermore, the court has ordered the confiscation of $4,350 of personal assets belonging to Fanaiyan's family members, seized during a residence inspection, in favor of the government.

Three other Baha'i citizens have been summoned to the Second Branch of the Sari Revolutionary Court on charges including "deviant educational and propagandistic activities contrary to Islamic law in Baha'i groups" amid crackdowns on the minority group.

The legal case for two other Baha'i citizens has been referred to the First Branch of the Babol Revolutionary Court on similar charges.

In recent months, pressures from security and judicial authorities on Bahai citizens have escalated. Unofficial sources estimate that over 300,000 Bahai citizens reside in Iran. However, the Constitution of the Islamic Republic only recognizes Islam, Christianity, Judaism, and Zoroastrianism as official religions.

Bahais constitute the largest religious minority in Iran and have faced systematic harassment and persecution since the Islamic Revolution of 1979.

A year after the detente restoring diplomatic ties between Saudi Arabia and Iran, relations between the regional rivals remain tense.

On March 10, the two nations agreed to reopen embassies and exchange ambassadors, ending a seven-year diplomatic freeze. However, progress has been slow, and ties between the countries remain at a minimal level.

Despite efforts to mend ties, including meetings between top security officials in Beijing and the signing of diplomatic and security cooperation agreements, Saudi Arabia and Iran have yet to translate diplomatic gestures into substantial agreements. The ongoing conflict in Yemen continues to hamper progress with the Iran-backed Houthi militia in Yemen still at work with Saudi-backed coalition forces.

The Israel-Hamas conflict has heightened the need for peacemaking efforts in the region, with concerns over Iran's support for proxies destabilizing the area. While there have been discussions regarding potential areas of cooperation, including Saudi investment in Iran's economy, disagreements persist over regional issues.

Saudi Arabia has discussed economic measures to incentivise Iran to reign in its proxies, but as the Houthis' blockade of the Red Sea continues to hamper global trade, the Saudi influence remains in question.

A major obstacle between the two remains to be claims over the Arash/Dorra oil and gas fields in the northern Persian Gulf, with Saudi Arabia and its allies refusing to recognize Iranian claims.

Saudi Arabia severed ties with Iran in 2016 following the storming of its embassy in Tehran during a dispute over Riyadh's execution of a Shiite Muslim cleric. Subsequent conflicts, including missile and drone attacks on Saudi oil facilities and tankers in the Persian Gulf from Iran's Houthi militia further strained relations amid an almost decade-long war.

The dust has settled on the highly engineered 2024 parliamentary election polls in Iran, prompting an evaluation of the management mechanisms and outcomes for the regime.

Following each manipulated election in Iran, where the precise level of participation remains undisclosed, and the resulting parliament remains loyal to the Supreme Leader, it becomes feasible to discern the impact on the regime's stability.

In brief, the fraudulent elections of 2024 not only failed to alleviate doubts regarding Iran's electoral procedures but exacerbated them. While such elections carry certain advantages, including a facade of democracy, temporary regime propaganda, and the stirring of dissent among opposition factions regarding participation, these benefits come at a cost. With the increasing challenges of manipulating votes, deceiving the public, and clandestinely tampering with ballots in the digital era, the feasibility of sustaining these manipulations is dwindling.

The lowest turnout ever delegitimized the next Majles (parliament) and Experts Assembly when the government desperately needed more legitimacy after its image became badly damaged in 2022-2023 repressions against the Mahsa Movement. The figures provided by the Ministry of the Interior and government propaganda channels regarding eligible voters (61 million instead of 65 million), disqualification of hundreds of candidates, and total turnout (40 or 41 percent compared to a more realistic 16-34 percent) have raised considerable doubts among the populace.

Materials related to these doubts are still being published in Iran, although the IRGC spokesman ordered news websites to stop discussing the elections three days after the vote and even before announcement of the official results.

Continued skepticism about statistics

Not only the opposition and the people in the streets and bazaars, but also former officials who are still in contact with government personnel, do not believe the official results. "Based on the calculations of the voting in Tehran and the most votes obtained, it seems that there were more than 500,000 invalid votes in Tehran," says Ali Rabi’i, a former high-ranking member of the Ministry of Intelligence in three administrations, and Minister of Labor. He is aware that he will be prosecuted if he does not have reliable sources. The government claims that well over 1.5 million votes were cast in Tehran without announcing the exact number, so blank or invalid protest votes were at least 25-30 percent of the total.

Glorious elections

Iranian officials called the election a miracle and epic. However, the candidates with the highest votes in 31 provinces won an average of 5% (from 2% to 17%) of votes according to the manipulated statistics of the Ministry of Interior from the 18-year-old and above population. Despite the non-participation of 59%, according to the official statistics, the many Reformists are still trying to prove their loyalty to the regime and their followers despite the fact that the regime barred them from the elections. Former President Mohammad Khatami did not even mention that he was not going to vote before the election day, which could have reduced participation even more.

The hardliners who engineered and carried out the now failed elections try to justify the low turnout by an inverted logic and strange excuses, while at the same time boasting about “good elections.” One of the excuses is the impact of US sanctions on voters, while according to their own logic of popular anti-American support, participation should have been higher. They also argue that if Supreme Leader Ali Khamenei’s guidelines and policies were fully implemented, more people would have voted. In fact, the current economic crises and the harsh repressive policies that drove away the voters are the direct results of Khamenei’s policies. His foreign policy, for example, has brought on the economic sanctions and lack of normalcy in Iran’s international ties that have impoverished the voters.