US sanctions IRGC-linked entity over 2024 election meddling

The United States on Tuesday imposed sanctions on entities in Iran and Russia, accusing them of orchestrating campaigns to meddle in the 2024 US presidential election.

The United States on Tuesday imposed sanctions on entities in Iran and Russia, accusing them of orchestrating campaigns to meddle in the 2024 US presidential election.

The Iranian entity sanctioned is the Cognitive Design Production Center, a subsidiary of Iran's Revolutionary Guards Corps (IRGC), which planned influence operations since at least 2023, according to the US Treasury.

"The Governments of Iran and Russia have targeted our election processes and institutions and sought to divide the American people through targeted disinformation campaigns," said Bradley Smith, Treasury's Acting Under Secretary for Terrorism and Financial Intelligence.

“The United States will remain vigilant against adversaries who would undermine our democracy,” he added.

The new measure comes in the wake of Donald Trump taking office as US president. The president-elect has promised to resume his maximum pressure campaign against Iran.

In October, the Treasury sanctioned seven agents working for the Islamic Republic for their efforts to influence the US presidential elections in 2020 and 2024. Before that, the treasury had designated Emennet Pasargad, believed to be the key component of IRGC’s cyber operation.

Findings by cybersecurity researcher Nariman Gharib and whistleblower group Lab Dookhtegan has underscored the role of Emennet Pasargad that, according to their joint report, carried out a campaign to “disrupt and incite tension in the elections, particularly in swing states.”

The measure announced on the last day of 2024 also includes the Moscow-based Center for Geopolitical Expertise (CGE), which the Treasury says circulated disinformation about candidates in the election and directed and subsidized the creation of deepfakes.

The CGE also manipulated a video to produce "baseless accusations concerning a 2024 vice presidential candidate," the US Treasury said without naming the targeted candidate.

"We remain committed to promoting accountability for those who seek to undermine our democratic institutions," the US State Department spokesman Matthew Miller posted on X.

A day after protests erupted at two of Tehran's traditional bazaars over the worsening economic crisis and soaring inflation, the goldsmiths bazaar joined the strike on Monday, December 30.

The unrest in Tehran's largest traditional market comes amid growing warnings from politicians and economists about Iran's dire economic state. Reformist politician Ali Mohammad Namazi told conservative outlet Nameh News, "The situation of the Iranian economy is alarming."

Namazi criticized President Masoud Pezeshkian for failing to deliver on campaign promises to "lift sanctions, facilitate international trade, and expand relations with other countries." He added, "The public is now demanding accountability for these unfulfilled promises."

"Iranians are uncertain about their future," Namazi said, warning that unresolved problems could escalate into crises. He also noted that the current instability benefits those with access to insider information while making long-term planning impossible for ordinary citizens.

Namazi further highlighted the structural challenges facing Iran, even if sanctions were lifted. "Even in the best-case scenario, restoring oil production to normal levels would require at least four months of intensive work due to neglected maintenance of oil wells," he explained.

Economic strains and potential unrest

Nameh News emphasized the falling value of the rial and persistent high inflation as key issues plaguing Iran's economy. In response, IRGC commanders and Iran's judiciary chief have stated they are prepared to handle potential unrest. Namazi warned that if the economic freefall, particularly the decline of the rial, is not controlled, widespread protests could ensue.

Geopolitical complications

Iranian foreign policy analyst Ghasem Mohebali told Nameh News that hardliners within Iran oppose lifting sanctions because a normalized economy could weaken their influence. "Hardliners in Iran, like their counterparts in the region and beyond, benefit from ongoing tensions," Mohebali said. He pointed out that global players, including Iran, Russia, the United States, and even China, have vested interests in maintaining instability in the Middle East to advance their own agendas.

"China, for instance, prefers regional tensions to keep the US and Europe distracted from focusing on the war in Ukraine and applying pressure over East Asia," Mohebali added.

Political pressures on the Pezeshkian administration

Amid the crisis, President Pezeshkian faces pressure from reformists and hardliners alike. The IRGC-linked Javan newspaper reported that reformist figures, including former President Mohammad Khatami and former Majles Speaker Ali Akbar Nateq Nouri, are urging Pezeshkian to tell Supreme Leader Ali Khamenei that the government cannot resolve the crisis without negotiating with the West.

Former Vice President Es'haq Jahangiri echoed this sentiment, stating, "Iran is in a difficult situation, and Tehran needs to negotiate with Trump and accept his conditions."

Meanwhile, the hardliner Kayhan newspaper, linked to Khamenei’s office, criticized Pezeshkian’s advisers and called for a government reshuffle. "The current deadlocks are the result of poor advice given to the President," Kayhan warned, adding that advisers suggesting the government is incapable of solving the crisis "are not well-wishers."

Unlike reformists advocating negotiations with the Trump administration, hardliners like Kayhan cautioned against trusting the US and its allies. "How many more times must we try to deal with the 'Great Satan' and its followers?" the publication asked.

A nation at a crossroads

As economic pressures mount and political divisions deepen, Iran's government faces an uncertain path forward. With internal protests and geopolitical complexities converging, Pezeshkian’s administration must navigate mounting challenges while addressing growing calls for accountability and decisive action.

Iran’s economy minister announced on Tuesday that the Supreme Leader has approved revisiting two critical international conventions required to ease banking restrictions resulting from Iran's blacklisting by the money laundering watchdog, the Financial Action Task Force (FATF).

Abdolnaser Hemmati wrote on X, "The president informed me that the Supreme Leader has approved revisiting the Palermo and CFT bills related to the FATF in the Expediency Discernment Council."

The Expediency Discernment Council, which mediates disputes between parliament and the Guardian Council (a constitutional watchdog), became involved after parliament approved the legislation but the Guardian Council rejected the two bills concerning the Palermo and CFT conventions regulating money laundering and financing of terror groups.

The Financial Action Task Force (FATF), established by the G7 member countries to safeguard the international financial system, influences banking policies in most countries and guides businesses aiming to protect their own integrity and reputations.

Iran's status on the FATF blacklist has had a major impact on its international banking operations. The country remains on the list of high-risk countries with serious strategic deficiencies in countering money laundering, terrorist financing, and proliferation financing.

Iran needs to finalize legislation enabling the enactment of two international conventions: the International Convention for the Suppression of the Financing of Terrorism (CFT) and the UN Convention against Transnational Organized Crime (Palermo Convention).

The dispute between the parliament and the Guardian Council was referred to the Expediency Council in 2019 for arbitration.

The Expediency Council has stalled the matter since then, neither approving nor rejecting the bills. The inaction is apparently due to objections from hardliners, such as the Chairman of the Expediency Council Sadeq Amoli Larijani, who argue that joining the conventions would harm Iran's national security by exposing its dealings with regional Tehran-backed allies—precisely the activities these international agreements are designed to address.

“If you ask my personal opinion, Palermo and CFT are extremely detrimental to national security,” Larijani said in 2020.

Iran will remain on the FATF's list of High-Risk Jurisdictions Subject to a Call for Action until it fully implements its action plan, including ratifying the Palermo and CFT. Only then will the FATF consider next steps, such as suspending countermeasures.

The FATF says it remains concerned about the terrorist financing risk from Iran and its threat to the international financial system until these measures are implemented.

Even if Iran joins the FATF, more must be done to attract foreign investment, Mohammad Khazaei, Secretary-General of the Iranian Committee of the International Chamber of Commerce (ICC), said earlier in the year.

Iran is struggling with a sharp decline in oil exports to China and seeks to offload reserves stored in Chinese ports ahead of Donald Trump's return to Washington.

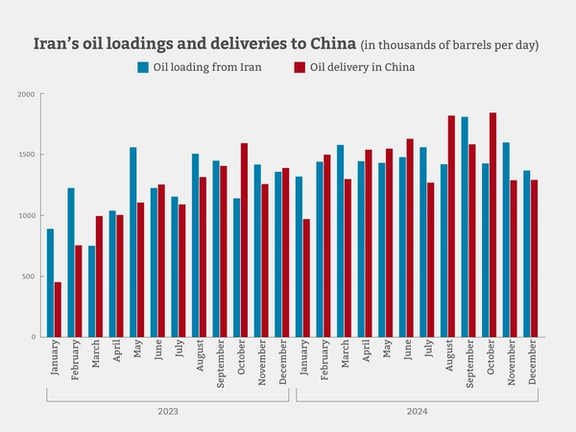

Data from Kpler, a commodity intelligence company that tracks oil tankers, reveals that Iran's oil exports to China have been declining since October. Over the past two months, daily oil deliveries from Iran to China have dropped below 1.3 million barrels, which is 550,000 barrels fewer than in October.

Meanwhile, Iran's unsold floating oil reserves have more than doubled during this period, reaching approximately 20 million barrels.

A source at the National Iranian Oil Company, confirming the significant decline in oil exports, told Iran International that the primary issue lies in logistics. The source explained that recent US sanctions targeting dozens of oil tankers have complicated the transport of Iranian oil to East Asian waters and its covert delivery to China: “Iran hopes to resolve this issue in the coming months by purchasing more tankers,” the source who wished to remain anonymous added.

So far, 380 tankers carrying sanctioned Iranian oil have been identified, with half added to the US blacklist.

Homayoon Falakshahi, a senior Kpler analyst, emphasized the challenges created by recent US sanctions on 35 tankers involved in covertly carrying Iranian oil, noting that half of the so-called "dark fleet" of tankers have been blacklisted.

These mostly old and uninsured tankers play a critical role by turning off their automatic identification systems, transferring cargoes mid-sea to other tankers, altering documents and oil branding via intermediaries, and ultimately delivering the shipments to Chinese ports.

Falakshahi also noted that Iran's only customers in China are small independent refineries known as teapots: “These refineries, due to their low efficiency and high pollution, are under pressure from Beijing to either modernize or shut down”.

Over the past few months, at least three Chinese teapots have officially declared bankruptcy.

Iran's oil reserves in China

In addition to its floating oil reserves, Iran is grappling with challenges related to its oil stocks stored at onshore facilities in Chinese ports.

Recently, Iran International reported, citing an informed source, that the Iranian government, with mediation by the Islamic Revolutionary Guard Corps (IRGC), is attempting to sell $1 billion worth of its oil reserves stored in Dalian Port, China.

The source provided updated information on December 27, revealing that the Iranian government has also launched coordinated efforts to release oil stored in Zhoushan Port, China.

According to the source, Iranian officials have begun investing in renting foreign, non-sanctioned oil tankers to conceal Iran's involvement in these efforts:

"Iran is carrying out operations to load this oil onto these tankers and then move it out of Chinese territorial waters to transfer the cargo mid-sea to other tankers. This is being done to hide the Iranian origin of the oil and to prevent exposure of its release and sale."

It is not precisely clear how much oil Iran has stored in Chinese ports. However, the value of the Islamic Republic's oil reserves in Dalian Port is estimated to be around $1 billion, equivalent to approximately 12 million barrels.

Iran’s oil exports and floating reserves

Kpler data shows that both the loading of oil from Iranian ports and the unloading of Iranian oil at Chinese ports sharply declined during November and December.

In addition to logistical issues and the shutdown of some Chinese "teapot" refineries, Donald Trump’s return to the presidency on January 20 with his pledge to "revive the maximum pressure policy" against the Islamic Republic is another factor behind the sharp drop in Iran’s oil exports to its sole customer, China.

During Trump’s previous presidency, US sanctions imposed on Iran in 2018 reduced Iran’s daily oil exports to below 350,000 barrels in 2019. Before the sanctions, Iran was exporting 2.5 million barrels per day.

Trump’s maximum pressure policy caused Iran’s floating oil reserves to surge to 110 million barrels in 2021. This is partly because some of Iran's oil exports are, in fact, gas condensate, produced from gas fields. If Iran wants to halt condensate production, it would also need to stop gas production, which is not feasible.

At that time, a significant portion of Iran’s floating oil reserves consisted of condensates.

With the surge in Iran’s oil exports to China during Joe Biden’s presidency, Iran delivered a large portion of its floating oil reserves to Chinese refineries. By January of this year, Iran’s floating condensate reserves dropped to zero for the first time since US sanctions, and this trend has continued.

However, since September, Iran’s floating crude oil reserves have doubled due to the decline in Chinese purchases, reaching 20 million barrels. Vortexa estimates this figure to be closer to 50 million barrels.

Iran stopped delivering oil to Syria after the fall of the Bashar al-Assad. However, in the first 11 months of this year, Iran delivered an average of 56,000 barrels of oil per day to Syria.

Overview of exports in 2024

On average, Iran has loaded 1.55 million barrels of oil per day this year, marking a 17% increase compared to 2023. Approximately 94% of these shipments have been delivered to China.

The cessation of oil shipments to Syria this month and the decline in Iranian oil deliveries to China, dropping below 1.3 million barrels over the past two months, come as President Masoud Pezeshkian’s government has set an ambitious target of exporting 1.85 million barrels of oil per day in next year’s budget bill.

Several analysts, officials and media outlets in Iran are warning that multiple crises have gripped the country in recent months and those in charge should deal with this reality.

“In recent months, the surge in both the number and variety of major challenges has intensified, pushing the situation beyond mere concern. Issues that were previously warned about as future risks have now become reality, exposing their full impact and severity,” Massoud Nili, professor of economics in Tehran, warned on social media.

Thousands of social media posts and numerous media reports from Tehran reflect a growing sense of decline and instability gripping the country. Multiple economic crises, including severe energy shortages and a rapidly depreciating currency, have converged with significant regional setbacks. Among these is the recent ousting of Bashar al-Assad, a major blow to Tehran’s regional standing. After investing tens of billions of dollars to sustain Assad’s rule, the Islamist opposition seized the capital, Damascus, in a matter of days, underscoring the fragility of Iran’s regional influence.

Ali Rabiei, the president's social affairs advisor, has highlighted the pressing issue of "social fatigue" in a recent op-ed published by the newspaper Shargh. In his analysis, Rabiei examined the current challenges facing the country and criticized the approach taken by the government's opponents. He urged Masoud Pezeshkian to prioritize addressing this growing societal concern, emphasizing its critical role in shaping the nation’s future.

“Iran's society is grappling with profound exhaustion, with younger generations showing signs of rebellion against the status quo. Addressing this widespread social fatigue demands a comprehensive effort to rebuild the nation’s social fabric. While foreign investment may not be immediately necessary for this endeavor, it is undeniable that prolonged sanctions have significantly contributed to the prevailing sense of despair, leaving deep social and political scars,” Rabiei wrote.

The most visible symbol of the current crisis, apart from shortages of electricity, is the rapid decline of the rial. The Iranian currency stands at a historic low against major currencies, with the US dollar trading well-above 810,000 rials on Saturday. The battered currency has lost one-third of its value since early September, when Israeli attacks weakened Tehran’s main regional military arm, the Lebanese Hezbollah.

Islamic Republic's aging leader, Ali Khamenei, has been largely silent on the growing crises at home, focusing his public remarks on regional developments. On December 22, he denied that Tehran has regional proxies, while at the same time threatening Syria's new government with impending instability.

A Reformist figure, Ataollah Mohajerani, warned the government of the continuing influence of the military in politics in an article published on Saturday, drawing a parallel with India and Pakistan, arguing that Iran risks becoming another state where the armed forces dictate policy. He then urged President Pezeshkian and other officials to pay attention to people’s demands.

“The government must pay attention to the people, seeing them clearly and hearing their voices. Ignoring their concerns risks a day when the public responds with a forceful, bitter, and unmistakable message.”

While the US dollar reached a new high against Iran’s currency on Wednesday, an economist warned that without an agreement with Washington soon, inflation could climb above 40% before the Iranian New Year in March.

Macroeconomist Morteza Afqah told Tehran’s Khabar Online news website on Wednesday that “If no agreement is reached, the likelihood of reinstating the ‘maximum pressure’ policy against Iran is high.

"Inflation could surpass 40% by the end of the year. Without the lifting of sanctions, the country appears incapable of managing the economy sustainably.”

Iran’s currency, the rial, has depreciated nearly 20-fold since 2018, when President Donald Trump first imposed "maximum pressure" sanctions on the country. Since September alone, the rial has lost an additional 30% of its value.

The current annual inflation rate is unclear, but official figures have hovered around 40% since 2019, with prices for food and other essentials rising at an even faster pace.

The rial was trading at nearly 800,000 per US dollar on Wednesday and over one million per British pound.

Supreme Leader Ali Khamenei’s administrative chief cleric Mohammad Mohammadi Golpaygani conceded on Wednesday that “We are not in a normal situation in the country. For years, we have been burdened by sanctions, facing difficulties in exporting oil.”

However, he added, “In these circumstances, the nation's power comes with its own challenges. After all, being a Muslim nation has its costs and is not something achieved easily.”

Afqah, in turn, expressed deep pessimism about the economy overall, seeing no reason to be optimistic.

"The short- and even medium-term outlook for our country’s economy is not promising. There isn’t much hopeful news or any so-called good news to cling to. Each individual economic and even non-economic factor is structured in a way that leads to rising costs, higher inflation, and a decline in economic growth rates," he said.

The pressure on Iran’s Islamic government is not just economic but also geopolitical, after its key non-state allies, Hamas and Hezbollah were seriously weakened by Israeli blows earlier this year, followed by the fall of President Bashar al-Assad in Syria.

Iran had invested tens of billions of dollars in keeping Assad in power against his domestic opponents, but in a matter of days, the armed opposition swept through the country, capturing Damascus and deposing the long-serving authoritarian president, who fled to Russia.

The incoming Trump administration has signaled that it is inclined to increase the pressure, not just to rein in Tehran’s nuclear program, but more likely to inhibit its power projections throughout the Middle East.