Iran and Brazil mulling trade in national currencies

Iran and Brazil have agreed to explore the use of their national currencies in bilateral trade, aiming to boost economic cooperation.

Iran and Brazil have agreed to explore the use of their national currencies in bilateral trade, aiming to boost economic cooperation.

ISNA reported that Iran and Brazil reached the agreement during a meeting between Deputy Central Bank Governor Asghar Abolhasani and Tatiana Rosito, Brazil's Secretary for International Affairs at the Ministry of Finance, held at a BRICS meeting in South Africa.

The nature of the agreement, whether written or a memorandum of understanding, was not specified.

Both sides highlighted the potential for increased trade and pointed to the need for leveraging BRICS mechanisms to enhance banking and financial ties.

Iran also held separate talks with Russia, India, South Africa, and the UAE, advocating for expanded financial collaboration within the BRICS bloc.

Last January, Iran officially became a member of the China-led BRICS economic organization, as it seeks to overcome the impact of US sanctions and overcome it isolation.

More than half of the tankers sanctioned three days ago by the United States for carrying Iran's oil have ceased operations outside Chinese or Iranians terminals, an investigation by Iran International reveals.

The sanctions announced on February 24 followed similar measures by the US Treasury in late 2024, targeting ultra-large crude carriers in Iran's shadow fleet.

Such vessels, widely referred to as VLCCs, or very large crude carriers, can carry up to 2 million barrels of oil, far more than what a normal or large tanker can carry.

The VLCCs are essential for Iran's oil shipment, hence their targeting by the US Treasury since October last year.

With the latest US sanctions imposed by the Trump administration, nearly two-thirds of the 126 VLCCs shipping Iranian oil have now been blacklisted, according to oil tanker tracking data, forcing a significant number to abandon Iran and turn to transporting Russian oil.

Trump administration’s long road

Although stricter sanctions have complicated oil transportation for Iran’s VLCCs, claiming that Iran’s oil exports will face severe disruption and a catastrophic decline would be an exaggeration.

United Against Nuclear Iran (UANI) has identified 503 tankers with a combined capacity of 61 million tons of oil (over 350 million barrels), but sanctions currently cover less than 45% of this total capacity.

An investigation by Iran International shows that to maintain an average daily oil transit of 1.3 million barrels, as observed in recent months, Iran needs 45 VLCCs. Currently, 47 VLCCs linked to Iranian oil smuggling remain unsanctioned.

Meanwhile, dozens of VLCCs worldwide have surpassed 20 years of age in the past year, with each valued at an average of $25 million. Operators of the shadow fleet could potentially purchase some of these aging vessels. Notably, the number of foreign tankers involved in smuggling Iranian oil has surged sevenfold over the past five years.

In January 2024, China banned sanctioned tankers from docking at Shandong Port, its largest terminal for Iranian crude imports, causing Iranian oil offloading to drop to 850,000 barrels per day. However, a recent policy shift privatized part of the port, facilitating the reception of sanctioned crude cargoes. As a result, Iranian oil discharges in China surged to over 1.7 million barrels per day in February, according to industry intelligence firm Kpler.

Thus, it appears that the US still has a long road ahead to achieve what Treasury Secretary Scott Bessent described as a “90% reduction goal” in Iran’s oil exports.

Previously, several oil tanker tracking companies, in interviews with Iran International, estimated that Iran’s daily oil exports could drop by one-third in the coming months. However, they all agreed that such a scenario depends entirely on China's cooperation with the US.

Iran’s Difficult Situation

While foreign energy analysts and media mostly focus on Iran’s oil export volumes, the most critical issue for Iran—and especially for the US—is its oil export revenue.

Oil tanker tracking data from recent months indicate that Iran’s export volume has declined by around 25%. However, Iran’s domestic financial data suggests that its oil revenue has been cut in half, dropping below $1.8 billion per month.

This clearly highlights the soaring costs Iran has incurred to bypass US sanctions in recent months.

Meanwhile, Masoumeh Aghapour, an economic advisor to Iran’s president, acknowledged the country’s severe foreign currency shortages on February 25, just a day after the latest US sanctions targeted oil-related companies and tankers.

“We have a currency problem. Let’s be frank. Trump has played a major role in our forex market. The situation has become exponentially more difficult for us in the past two weeks,” she said.

Since early September, Iran’s national currency, the rial, has lost half of its value due to setbacks in the region and Trump’s election, as he has pledged to significantly cut Tehran’s oil exports.

Iran’s former communications minister has sharply criticized the government-controlled economy, arguing that a system favoring insiders stifles creativity and productivity.

“The reality is that in an economy built on rent-seeking, where wealth depends on political connections, creativity has no place,” Mohammad-Javad Azari-Jahromi, who served as telecommunications minister under the Rouhani administration, told a gathering of fintech experts in Tehran.

As Iran’s oil-dependent economy has plunged into crisis over the past five years, local economists, some media outlets, and politicians have increasingly criticized the underlying system while also attributing the downturn to US sanctions.

The term “rent-seeking economy” is increasingly used in Iran to describe a system where politically influential individuals and entities secure economic privileges—such as government subsidies, lack of oversight, and market monopolies—to generate profits without contributing significantly to productivity.

A clear example is the Revolutionary Guard receiving over 30% of Iran’s crude oil for export, rather than relying solely on government budget allocations.

Jahromi implicitly referred to that when he said, “Certain entities can obtain oil under the pretext of bypassing sanctions and then decide whether or not to bring the revenue back. This approach is far easier than putting in the effort to create markets and provide services.”

The former minister explained that “In this rent-seeking environment, there is no incentive for individuals to pursue creativity. Ultimately, the system operates through intermediaries.”

Nearly all of Iran’s banks, automakers, petrochemical plants, steel producers, and various other industries are either government-owned or quasi-public, managed by a politically connected elite. Despite their inefficiency and mounting debts, these industries are deemed essential and remain heavily reliant on continuous government support.

Jahromi noted that banks use their capital to engage in the real estate sector instead of helping new industries. They also own many companies and lend money to their own enterprises instead of others.

“The economy is facing fundamental and obvious obstacles. In this situation, the workforce is migrating, and investment is scarce due to the high level of risk involved,” Jahromi said.

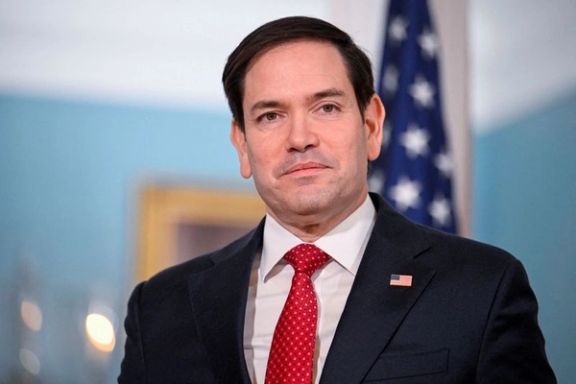

US Secretary of State Marco Rubio and Iraqi Prime Minister Mohammed Shiaa al-Sudani discussed Iran’s regional influence, Iraq’s energy independence, and US business investments during a call on Tuesday, the US State Department said.

According to spokesperson Tammy Bruce, both sides emphasized the need for Iraq to reduce reliance on external energy sources, swiftly reopen the Iraq-Turkey Pipeline, and uphold contractual commitments to U.S. companies to attract further investment.

Bruce added that "the two sides also discussed reducing Iran’s malign influence and continuing efforts to prevent ISIS from resurging and destabilizing the broader region."

Iran's President Masoud Pezeshkian said Tehran is committed to boosting ties with Moscow in a meeting with Russian Foreign Minister Sergei Lavrov on Tuesday, as both powers weigh how to deal with new US President Donald Trump.

"Iran and Russia have appropriate capacities to strengthen cooperation with each other, and we are determined to strengthen the interactions between Tehran and Moscow," Pezeshkian said.

"Iran and Russia have similar views on regional issues and seek to strengthen their regional and international cooperation", he added.

Moscow was dealt a boost this month as Washington under Trump emphasized the swift ending of the war Ukraine and restoration of bilateral ties.

Tehran, mired in economic malaise, faces a trickier choice dealing with Trump, who has ruled out allowing Iran acquiring a nuclear bomb and said he wants a deal which Iran's Supreme Leader Ali Khamenei has ruled out.

Pezeshkian also urged for expediting the implementation of agreements, especially a Comprehensive Strategic Agreement between the two countries.

Tehran and Moscow signed a long-term agreement in March 2001 which was initially set for a ten-year term but was extended twice, each time for five years. Despite prior discussions, similar promises to finalize a renewed treaty have remained unfulfilled.

Lavrov, who conveyed Russian President Vladimir Putin’s greetings to Pezeshkian, said: “Iran and Russia have many common interests in continuing effective regional cooperation with each other.”

In a press conference following separate discussions with Lavrov, Iranian Foreign Minister Abbas Araghchi ruled out direct negotiations with the United States over the country’s nuclear program.

"Regarding Iran's nuclear issue, we will move forward and coordinate our positions in cooperation with our friends in Russia and China," Araghchi said.

"Iran's position in the nuclear talks is completely clear, and we will not negotiate under pressure and sanctions. There is no possibility of direct negotiations between us and the US as long as maximum pressure is being applied in this manner," he added.

Tehran’s envoy to Moscow, Kazem Jalali, also said the discussions specifically covered the nuclear issue and joint approaches in the field.

Oil prices rose for a second consecutive day on Tuesday as fresh US sanctions on Iran raised concerns over tighter supply, while strong global refining margins signaled steady demand for crude, Reuters reported.

Brent crude futures rose 15 cents to $74.93 a barrel by 0724 GMT. US West Texas Intermediate crude futures climbed 23 cents to $70.93 a barrel.

"In the short term, I continue to think crude oil is looking for a base. The fresh US sanctions announced on Iran overnight will likely assist with this as will the Iraqi oil minister's commitment to rein in its oversupply," Reuters quoted IG market analyst Tony Sycamore as saying.

The United States rolled out new Iran-related sanctions, the Treasury and State Departments announced on Monday, targeting companies and individuals including the head of Iran's national oil company.

The measures target over 30 brokers, tanker operators and shipping firms the treasury department accuses of facilitating the trade from which Iran derives most of its state revenue, including for regional military operations Washington opposes.

They come after President Donald Trump this month reinstated the "maximum pressure" campaign on Iran from his first term, with the stated aim of driving its oil sales to zero.

Iran, the third-largest producer in the Organization of the Petroleum Exporting Countries (OPEC), pumped 3.2 million barrels per day in January, according to a Reuters survey.